Chasing a potential client for a signed retainer agreement is a drain on your small firm. Every email you send and every voicemail you leave is a window for that client to call your competitor, costing you the business.

A lawer retainer fee is the upfront payment that kicks off the engagement, but collecting it shouldn't be a multi-day administrative nightmare. It should be a single, five-minute transaction that secures the client before they have time to second-guess their decision.

Why a Slow Retainer Process Is Costing You Clients

Are you tired of the endless email chains and phone tag just to get a new client in the door? That friction doesn't just waste your time; it actively costs you business. The longer it takes to get that retainer agreement signed and the fee paid, the more likely a lead will lose momentum.

The High Cost of Delay

In the race to sign a new client, speed is everything. The data shows that leads contacted within the first five minutes are 21x more likely to convert. But if your follow-up involves sending three separate links for an agreement, an invoice, and an intake form, you’re just reintroducing the delays that kill deals.

This guide is built for busy law firm owners. We’ll demystify the lawyer retainer fee, covering the different models and ethical rules. More importantly, we'll show you how to turn that slow, multi-step chase into a single transaction.

Turn "Yes" into a Signed Retainer, Instantly

Fixing your retainer process is the key to improving cash flow and your entire client intake process. The goal is to make it incredibly easy for a client to say "yes" and commit financially, right at the peak of their motivation.

When you get the signature and payment in one step, you slash client drop-off, fix your cash flow, and make a powerful first impression. You'll have a clear roadmap to structure, explain, and collect retainer fees with zero friction—locking in clients before they go cold.

What Is a Lawyer Retainer Fee, Really?

A potential client's "yes" means nothing until that retainer is paid. The lawyer retainer fee is the step that makes your relationship official, but explaining it poorly creates the hesitation that gives them time to second-guess everything. Don't let confusing terms kill your momentum.

Think of it as a deposit for a top-tier builder. Your client pays an advance to reserve your time and guarantee your focus. This isn't just a payment; it's the financial commitment that turns a warm lead into a paying client.

More Than a Simple Deposit

A retainer secures your availability. You're promising to prioritize their matter and, in many cases, agreeing not to represent a competitor. That’s a huge distinction. A deposit pays for a product, but a retainer secures your professional service.

Getting this point across justifies the upfront cost. You shift the conversation from "paying for work you haven't done yet" to "investing in a dedicated legal advocate." This simple reframing can smooth out friction and shorten the time it takes to get retained.

The Retainer Workflow Explained Simply

The mechanics are simple, but you must explain them with clarity. Here’s the typical flow:

- Agreement & Payment: The client e-signs your agreement and pays the fee in one seamless action.

- Funds Held in Trust: You deposit these unearned funds into a special client trust account (IOLTA), separate from your firm’s operating cash. This is a non-negotiable ethical rule.

- Billing Against Retainer: As you perform work, you bill your hourly rate against the funds in that trust account.

- Transferring Earned Fees: Only after you've invoiced the client for completed work do you transfer that earned portion from the trust account to your operating account.

- Replenishment or Refund: The client may need to top up the retainer if it gets low. If the case wraps up with a balance, you must promptly return every penny to the client.

Mastering this explanation builds instant trust. For a deeper look at turning inquiries into signed clients, check out our complete guide to stopping leads from going cold and achieving faster conversions.

Choosing the Right Retainer Fee Model for Your Firm

Picking the wrong retainer model is like trying to hammer a nail with a screwdriver—inefficient and frustrating. The right model brings predictability to your cash flow and sets clear client expectations from day one. Get it wrong, and you're setting yourself up for billing disputes.

Let's break down the four most common models. We’ll look at where each one shines and how to pick the best fit for your cases.

General Retainer (The Availability Fee)

A general retainer is a fee a client pays just to keep you on call. They aren't paying for specific work; they're paying to guarantee you'll be available. Just as importantly, they're paying to ensure you won't represent their competitors. This fee is earned on receipt.

- Best For: Corporate clients needing on-demand advice or high-profile individuals wanting to lock in a top lawyer.

- Key Consideration: Your agreement must be razor-sharp: the fee covers availability only. All actual legal work is billed separately.

Security Retainer (The Advance on Fees)

This is the bread and butter for most small law firms. A security retainer is an advance payment for services you're about to perform. You are ethically required to deposit this lump sum into a client trust account.

As you do the work, you bill your time against that fund. The money only becomes yours after you’ve earned it. Any money left at the end of the case must be promptly returned to the client.

Evergreen Retainer (The Self-Replenishing Fund)

The evergreen retainer is a smarter version of the security retainer, designed for long cases. Your agreement states a minimum balance that must be maintained in the trust account. When your work dips the balance below that threshold, the client is required to deposit more funds.

- Best For: Complex litigation, messy family law cases, or any matter expected to span many months.

- Key Benefit: This model is a lifesaver for your firm's cash flow. It stops you from chasing payments mid-case or funding the litigation yourself.

Flat Fee Retainer (The Project-Based Fee)

A flat fee retainer is a single, all-in price for a clearly defined legal project, like drafting a will or handling an uncontested divorce. Data shows the average lawyer retainer fee is between $1,973 and $4,015, though this shifts dramatically by practice area. You can learn more about how hourly rates and fees vary across states at LawPay.com.

Clients love the cost certainty. For your firm, it rewards efficiency—the faster you complete the work, the more profitable it becomes.

Comparing Common Lawyer Retainer Fee Models

| Retainer Type | Primary Use Case | Billing Mechanism | Key Firm Consideration |

|---|---|---|---|

| General Retainer | Securing lawyer's availability for a set period. | Earned on receipt. Separate billing for actual work. | Must clearly state the fee is for availability only. |

| Security Retainer | Pre-payment for future hourly work. | Funds held in trust; billed against as work is done. | Most common; requires strict trust accounting. |

| Evergreen Retainer | Long-term cases with ongoing legal needs. | Security retainer that client must replenish when low. | Excellent for cash flow, prevents working on credit. |

| Flat Fee Retainer | Well-defined, predictable legal projects. | A single, upfront price for the entire scope of work. | Rewards efficiency but risks underpricing complex work. |

Many firms use a mix—flat fees for predictable work and evergreen retainers for complex litigation—to ensure financial stability.

How to Calculate and Ethically Manage Retainer Funds

Setting your retainer fee can feel like a tightrope walk. Go too low, and you're working for free. Go too high, and a great client might walk. The sweet spot is a lawyer retainer fee that protects your time without giving your client sticker shock.

Thankfully, you don't need a complex model. All it takes is a practical approach that accounts for the realities of the case.

A Simple Formula for Your Retainer Calculation

First, realistically estimate the initial chunk of work. Think through what the first 30 to 60 days will actually look like: filings, discovery, client meetings, research.

For most cases, this simple formula is all you need:

(Estimated Initial Hours x Your Hourly Rate) + Anticipated Expenses = Initial Retainer Amount

- Your Hourly Rate: Make sure this reflects the market. Lawyer hourly rates shot up 28% between 2016 and 2023. You can see what lawyers charge for their services in the 2023 Legal Trends Report.

- Anticipated Expenses: Are there immediate hard costs like filing fees or expert consultations? Add them in.

Let’s say you expect 15 hours in the first month at $350/hour, plus a $500 filing fee. The math is simple: (15 x $350) + $500 = $5,750. Now you have a solid, defensible number.

The Non-Negotiable Rule: Client Trust Accounts

How you manage that money is where your law license is on the line. Once a client pays a security retainer, that money is not yours. It belongs to the client until you've earned it.

Every dollar of an unearned retainer must go directly into a client trust account (IOLTA). This account must be completely separate from your firm’s operating account. Mixing them is called commingling funds, and it's one of the fastest ways to get a nasty letter from the state bar.

The Trust Accounting Workflow to Follow

The process is straightforward, but you have to follow it with precision every time.

- Deposit All Unearned Funds: The client’s entire retainer payment goes into your IOLTA. No exceptions.

- Perform the Work: You draft the motion, show up for the hearing, advise your client.

- Send a Detailed Invoice: Send the client a clear invoice breaking down the work performed and the total amount earned.

- Transfer Only the Earned Amount: After sending the invoice, transfer the exact earned amount from the IOLTA to your operating account.

- Return Unused Funds Promptly: If the case ends with money in the trust, refund it to the client without delay.

Getting these mechanics right is essential. We cover this in our guide on how a lawyer retainer works. Proper trust accounting demonstrates the professionalism every great client relationship is built on.

Drafting an Ironclad Retainer Agreement Clause

Your retainer agreement is your best defense against billing disputes. A vague or poorly worded retainer clause is a recipe for confused clients, awkward calls, and unpaid invoices. Getting this right sets crystal-clear expectations and builds trust from day one.

A strong clause stops scope creep and ensures you get paid without a fight. It needs to be so clear a client reads it once and knows exactly what they're paying for.

Key Components Your Retainer Clause Must Have

Think of your retainer clause as a mini-contract inside your main agreement. It has one job: spell out every detail related to the lawyer retainer fee, leaving zero room for interpretation.

Your clause must include these four elements:

- The Exact Retainer Amount: Be specific. State, "A retainer of $5,000 is due upon signing this agreement."

- A Clear Scope of Services: Detail what the retainer covers. Specify your hourly rate and explain it's an advance against future work. Also clarify what it doesn’t cover, like court filing costs or expert fees.

- Billing and Replenishment Terms: Explain your process. If using an evergreen model, define the minimum balance (e.g., "$1,500") and the client’s duty to top it up within a specific timeframe (e.g., "within 10 days of notice").

- Conditions for Refunds: Reassure the client by stating that any unearned portion will be promptly refunded when the matter concludes. This single sentence aligns with your ethical duties and shows you're operating in good faith.

Sample Language You Can Adapt

Putting these pieces together, a solid clause starts to take shape. For a deeper dive, you can explore our legal retainer agreement template.

Here's an example of what that looks like in practice:

Retainer Fee: Client agrees to pay the Firm an initial retainer of $5,000, due upon execution of this Agreement. These funds will be deposited into the Firm's client trust account. The Firm will bill its time at $350 per hour and draw from these funds only after providing Client with a detailed monthly invoice. This retainer does not cover out-of-pocket costs like filing fees, which will be billed separately.

Replenishment of Retainer: Client agrees to maintain a minimum balance of $1,500 in the trust account. If the balance falls below this amount, the Firm will notify the Client, and the Client agrees to replenish the retainer to the original $5,000 within ten (10) business days.

Refund of Unused Funds: Any unearned portion of the retainer remaining in the trust account at the conclusion of the Firm's representation will be refunded to the Client within thirty (30) days.

This language is direct. It sets firm boundaries and walks the client through the process, creating a professional, transparent experience from the start.

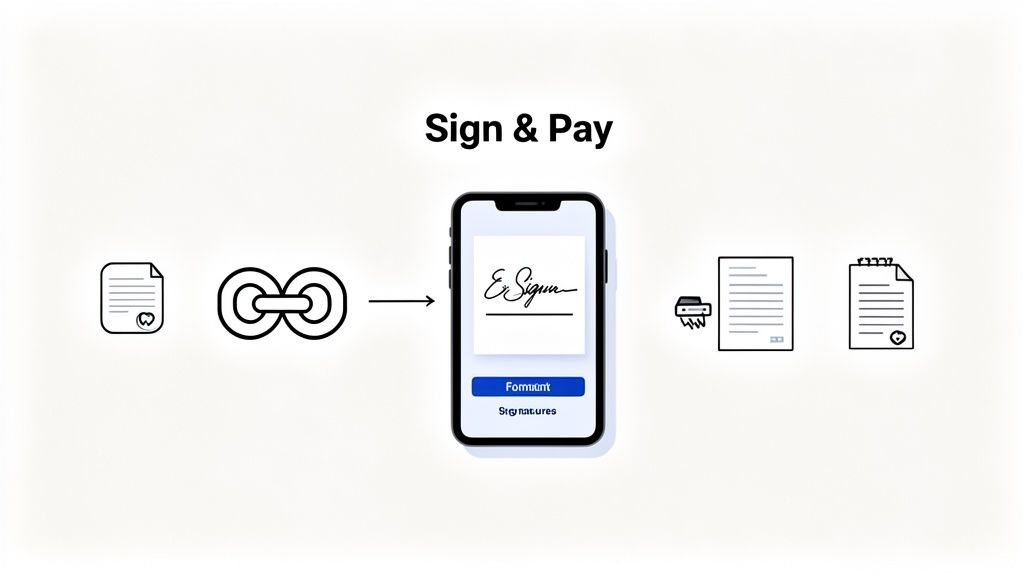

How to Automate Retainer Collection and Intake

You lose clients in the gap between their "yes" and the signed, paid retainer. Every email you send, PDF you attach, and separate payment link is another chance for them to hesitate or call a competitor. The old, manual way of collecting a lawyer retainer fee is a massive source of client drop-off.

Let's be honest, the traditional method is a clunky mess. You email an agreement, hope they have a scanner, send a separate invoice, then follow up for intake info. This disjointed process feels unprofessional and creates deal-killing delays.

From Three Emails to One Link

Modern intake tools collapse this entire sequence into a single step. Instead of juggling multiple platforms, you send the client one branded link. When they click it, they’re guided through a simple, mobile-friendly flow.

This unified approach lets a potential client:

- Review and e-sign your retainer agreement.

- Pay the full retainer securely with a credit card.

- Complete your intake questionnaire.

A motivated client can do all three from their phone in under five minutes. This eliminates the back-and-forth and secures their commitment before they can second-guess their decision.

Why Automation Is a Competitive Advantage

Adopting this workflow is about running a more profitable firm. The hard truth is that attorneys spend 48% of their time on non-billable administrative tasks. Automating your retainer and intake process directly attacks that number.

The right client intake software for law firms can automatically create a client file, log the payment, and save the signed agreement without anyone on your team lifting a finger. When a client can hire you with a few taps on their phone, it sends a powerful message: your firm is modern, professional, and easy to work with.

Common Questions About Lawyer Retainer Fees

Even with a clear agreement, clients will have questions. Having direct, confident answers ready is one of the best ways to build trust and keep the intake process moving. The more prepared you are, the smoother the engagement begins.

How do I explain a retainer fee to a client?

Keep it simple and relatable. Explain that a retainer works like a deposit to secure your firm’s dedicated time for their case. Be clear that it's an advance payment against future work, not the total cost.

Always emphasize that any unearned portion is fully refundable. Presenting the fee agreement and payment request together in one seamless step reinforces this transparency and makes it easy for them to say yes.

How should I handle disputes over retainer charges?

When a dispute pops up, your signed retainer agreement is your first line of defense. The conversation should start by referring back to the clear terms they signed. Your fee agreement should leave no room for interpretation.

The real secret is preventing disputes before they start. Send detailed, itemized invoices showing exactly how their funds were used. If a disagreement still happens, handle it professionally and document every conversation.

What happens when a retainer fund runs out?

This should never be a surprise to you or the client. Your retainer agreement must include an "evergreen" clause that requires the client to replenish their funds once the balance drops below a specific amount (e.g., $1,500).

Your billing workflow should back this up with automated reminders when their balance is low. This system ensures no interruption in your work and prevents you from unintentionally financing their case. It is a critical tool for maintaining your firm's cash flow.

Can I offer different retainer options to the same client?

Absolutely—and you should. Offering flexibility can be a powerful way to close a deal. For a predictable case, offer a flat fee retainer. For a more complex matter, a traditional security retainer is a better fit.

Presenting options gives clients a sense of control and allows them to choose a structure that fits their budget. This flexibility can be the factor that convinces them to hire your firm over a competitor. Just be sure to clearly define the scope and terms for each option.

With intake.link, you can stop losing leads in the gap between "yes" and "paid." We turn your entire intake—forms, signatures, and retainer payments—into a single, secure link.

Stop losing leads—get signatures before they call another firm.