Getting your firm's 1099s wrong means wasted time and painful IRS penalties. The rules around the 1099 for attorney fees feel intentionally confusing, but getting them right is non-negotiable if you want a stress-free tax season. This guide cuts through the noise and gives you exactly what you need to know.

Your No-Fluff Guide to 1099 Reporting

Think of this as your roadmap to getting 1099s right so you can focus on clients, not tax forms. We’ll cover exactly when you must issue a 1099, which form to use, and how to navigate tricky situations like settlement proceeds and payments to incorporated firms. You'll get a clear handle on the key thresholds and deadlines that matter when you pay co-counsel, hire a contract attorney, or get paid from a client's settlement.

Understanding your duties is step one. The IRS keeps a close eye on law firms—you handle client funds and are generally high-income professionals. Failing to file can trigger audits and penalties that start at $60 per form and climb quickly. The real challenge isn't just filing the forms; it's having a reliable system to track the data all year long. Attorneys already spend an average of 48% of their time on non-billable admin tasks, and scrambling for financial data is a huge part of that.

This is where your firm's operational efficiency becomes critical. Building financial tracking into your daily processes can make tax time a non-event. For more on this, our guide to law firm operations systems that scale shows you how to eliminate the manual work that bogs down small firms.

What This Guide Covers

We're going to break down the essentials in a practical way, giving you what you need to stay compliant. Here’s what’s ahead:

- The Critical $600 Threshold: The simple rule that kicks off most of your reporting duties.

- 1099-NEC vs. 1099-MISC: How to pick the right form and box for every payment.

- Settlement Proceeds: This is the single biggest source of confusion, and we'll show you how to handle it correctly.

- Systemizing Your Process: How to track payments and get ready for tax season without the last-minute chaos.

The Magic Number: Understanding the $600 Threshold

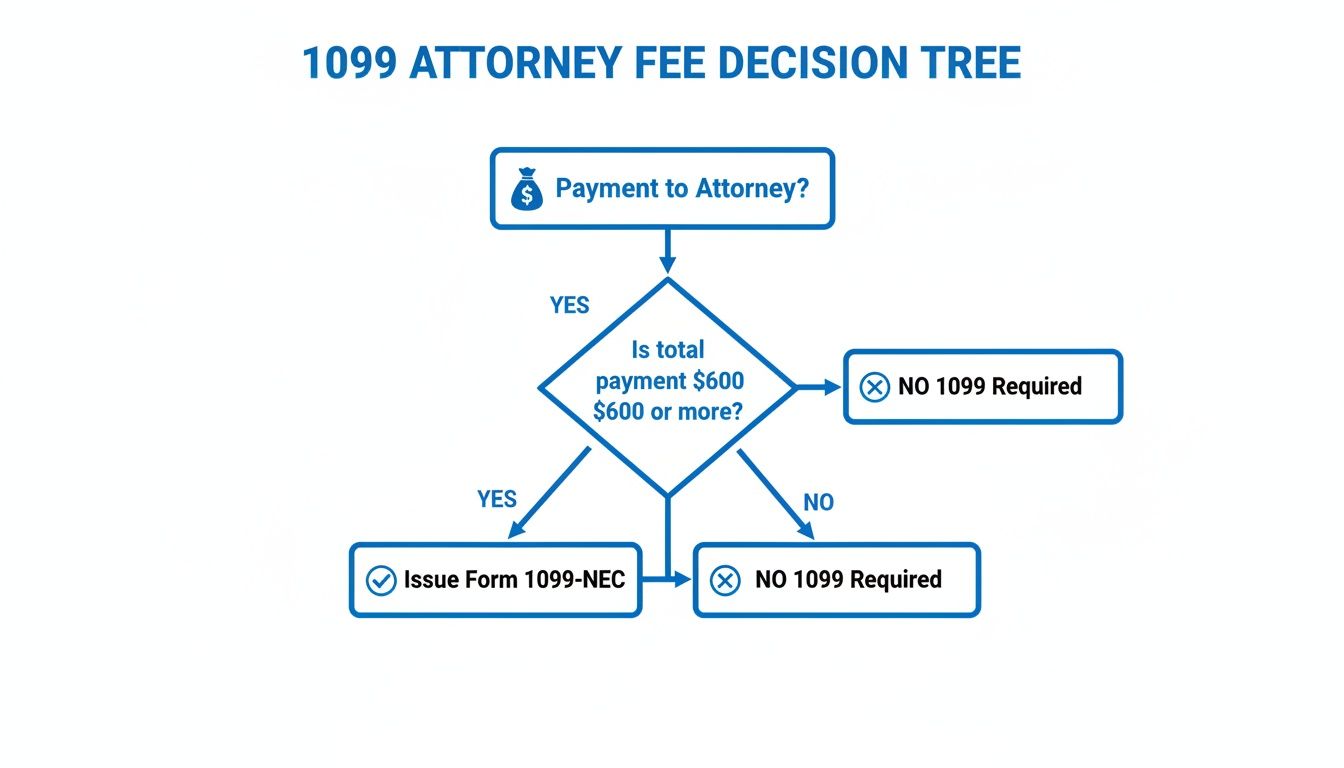

If there’s one rule to burn into your memory about 1099s for attorney fees, it's the $600 threshold. It’s deceptively simple: if your firm pays a total of $600 or more to another attorney or law firm for legal services within a calendar year, you have to send them a tax form.

This isn't about the money your firm receives; it's about the money you pay out. Think about common scenarios—paying a referral fee, bringing on co-counsel, or hiring a contract attorney. Each payment adds up. Once the total to a single person or firm hits $600, the IRS says your reporting duty is triggered.

Forget What You Know About the Corporation Exception

Here's where things get tricky, and it's a massive point of confusion. Normally, you don't have to issue 1099s to incorporated businesses. But for lawyers? That rule goes right out the window.

You must issue a 1099 for payments of $600 or more made for legal services, even if the recipient is a C-Corp or S-Corp. This is a special IRS carve-out for the legal profession, and it’s a common tripwire for non-compliance.

This means you have to track payments to every single outside attorney you work with, regardless of how their business is structured. Ignoring this exception is one of the easiest ways to get unwanted IRS attention.

Track Your Payments or Pay the Price

Letting these payments slip through the cracks gets expensive. The IRS penalty for late filing starts at $60 per form and goes up from there. That might not sound like much, but it multiplies quickly if you’ve worked with several attorneys throughout the year.

This is exactly why you need a system to tag and monitor these payments as they happen, not in a frantic rush at the end of January. For a deeper dive into these requirements, this law firm financial management guide is an excellent resource.

Let’s look at a few real-world examples of payments that count toward that $600 limit:

- Referral Fees: You pay another lawyer $1,000 for sending a client your way.

- Co-Counsel Fees: You partner with another firm and pay them $5,000 for their share of the work.

- Contract Attorney Services: You hire a freelance lawyer and pay three separate invoices totaling $2,500.

- Expert Consultation: You pay a specialized attorney $750 for a one-hour consult.

In every one of these situations, your firm is the payer, and you are responsible for issuing a Form 1099.

Choosing Between Form 1099-NEC and 1099-MISC

Picking the right 1099 form is half the battle. When it comes to reporting 1099s for attorney fees, you have two primary options: Form 1099-NEC for direct payments for legal work, and Form 1099-MISC for other situations, most notably settlements.

Knowing which form to use is absolutely critical for staying compliant.

When to Use Form 1099-NEC for Attorneys

Think of the Form 1099-NEC as the go-to for paying a lawyer for their actual legal services. This is your workhorse form.

If you’re paying another attorney directly for their professional expertise—like a referral fee, payments to co-counsel, or hiring a contract lawyer—you’ll use the 1099-NEC. The total amount you paid them for the year gets reported in Box 1, Nonemployee Compensation. Simple as that.

When to Use Form 1099-MISC for Attorneys

This is where things get more specific. The biggest exception, and the one that trips most people up, involves settlement proceeds.

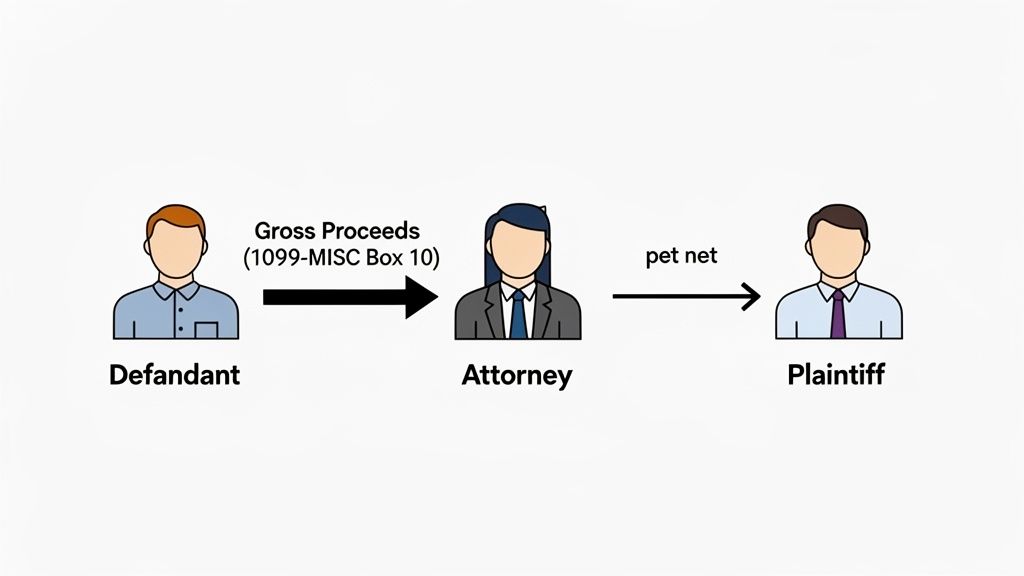

When a defendant or their insurance company pays a settlement to an attorney on behalf of the attorney's client, those gross proceeds must be reported on Form 1099-MISC in Box 10.

The IRS rule is clear: Box 10 is reserved exclusively for reporting the gross proceeds paid to an attorney in connection with legal services, not for the services themselves. This gives the IRS a paper trail of the total funds that moved through the attorney’s trust account before any fees were taken out.

This decision tree flowchart breaks down the basic thinking for choosing the right form.

The real takeaway here is that the nature of the payment dictates the form, not just the fact that you're paying a lawyer.

Quick Guide to 1099-NEC vs 1099-MISC

Here’s a quick comparison table to help you nail it every time. Just find the scenario that matches yours.

| Payment Scenario | Which Form to Use | Which Box to Use | Key Consideration |

|---|---|---|---|

| Paying a $2,500 referral fee to another attorney | 1099-NEC | Box 1 | This is direct payment for a professional service. |

| Paying $10,000 to a co-counsel firm for their work | 1099-NEC | Box 1 | You are compensating them directly for legal services. |

| An insurance company pays a $100,000 settlement check to your firm | 1099-MISC | Box 10 | The payer is reporting the total gross proceeds of the settlement. |

Getting this right from the start saves you from mismatched records and future inquiries from the IRS. Before you issue a 1099, ask yourself: "Am I paying this attorney for their services, or is this a settlement pass-through?"

How to Report Settlement Payments Correctly

Settlement payments are easily the biggest source of confusion when handling a 1099 for attorney fees. Get this part wrong, and you can create serious tax headaches for both your firm and your client. It all boils down to one question: who is paying whom?

When a defendant or their insurance company cuts a check for a settlement, they must issue a 1099 to both the plaintiff and their attorney if your fees are paid from those funds. The critical detail is that they must report the gross proceeds. This means your law firm will get a Form 1099-MISC showing the total settlement amount—not just your slice—reported in Box 10.

The Commissioner v. Banks Ruling and Your Client

At the same time, the payer sends your client a Form 1099-MISC for that exact same full settlement amount, usually reported in Box 3 (Other Income). This happens even though your client only ever sees the net proceeds after you've taken your fees and costs.

No, it's not a mistake. This is the direct result of a landmark Supreme Court decision that changed the game.

The 2005 Supreme Court decision in Commissioner v. Banks established that plaintiffs in contingent fee cases must recognize gross income equal to 100% of their recovery. This holds true whether the attorney is paid directly from the settlement funds or not.

In the eyes of the IRS, the entire settlement is your client's income first. Your fee is an expense they paid out of that income. This is often a shock to clients. You can learn more about the tax implications of this ruling and how it impacts plaintiffs.

Your Role in Managing Client Expectations

Because of this, you have a crucial job: manage your client’s expectations long before tax season. When you're disbursing settlement funds, walk them through this process.

Here’s exactly what to tell them:

- "You are going to get a 1099 for the full settlement amount." This one sentence prevents a panicked phone call in April.

- "Our fee is generally a deductible expense for you." Advise them to give the 1099 they receive, along with your final settlement statement, to their tax professional.

- "Our firm gets a 1099 for the same amount." Let them know you also report the gross proceeds, which you then reconcile against your business income and the funds you passed to them.

Explaining this isn't just good client service—it's a necessity that saves everyone a ton of stress.

Use Smart Systems to Nail Your 1099 Process

Trying to manually track payments all year is a recipe for a January meltdown. It’s a massive time sink and prone to costly errors. You need a smart system that does the heavy lifting, ensuring your 1099 for attorney fees process is smooth and painless.

This process starts before you even cut a check. The single most important thing you can do is get a signed Form W-9 from every single attorney or firm you plan to pay. Don’t pay them until you have it. This gives you their Taxpayer Identification Number (TIN) and confirms their business structure—two things you absolutely must have.

Unify Your Financial Workflow

Relying on scattered spreadsheets or a patchwork of tools is asking for trouble. A unified payment and practice management system is critical for handling both the 1099s you issue and the ones you receive. A single source of truth for every dollar in and out makes tracking almost effortless.

This centralized record makes it infinitely easier to monitor your firm's gross proceeds and quickly reconcile the 1099s that show up from opposing counsel. A clean, consolidated view of your financials is your best defense against tax-time surprises.

Automate the Administrative Drag

Automation is the key to getting your time back. We know that attorneys already spend an average of 48% of their day on non-billable admin tasks, and wrestling with financial cleanup is a huge part of that wasted effort.

The goal is to make 1099 preparation a simple byproduct of your daily operations, not a separate, stressful project. When your systems capture the right data from day one, tax compliance becomes routine.

Implementing robust law firm operations systems that scale is how you get there. By building W-9 collection and payment tagging directly into your workflows, you slash the risk of manual errors and ensure you have an accurate financial picture when it's time to file.

Here’s how a smart system keeps you ahead of the game:

- Automated W-9 Collection: Make W-9 requests a standard, automated part of onboarding new vendors or co-counsel.

- Payment Tagging: Tag every outgoing payment that crosses the $600 threshold. This lets you generate a perfect report in seconds.

- Centralized Records: Keep all your financial documents—invoices, W-9s, and payment confirmations—in one secure, easily searchable place.

A systemized approach transforms 1099 season from a chaotic scramble into a simple task, freeing you up to focus on billable work.

Meeting Deadlines and Your Actionable Next Steps

It’s easy to let reporting requirements slide. The video below breaks down why that's a risky move and how to stay ahead.

When it comes to filing 1099s for the previous year's payments, there's one date that truly matters: January 31. This is the hard deadline to get both Form 1099-NEC and Form 1099-MISC to the recipient and the IRS.

Missing this date isn't just an inconvenience. It comes with penalties that start at $60 per form and only get steeper. The only way to avoid that frantic January scramble is to build a simple, repeatable process into your firm's operations.

Your Year-Round Action Plan

Stop thinking about 1099s as a once-a-year headache. Instead, make compliance a routine part of how you handle every payment. This simple shift turns a major administrative burden into a quick box-checking exercise.

Here’s exactly how to do it:

Collect a W-9 Before You Pay. This is the golden rule. Make it a non-negotiable policy to get a completed Form W-9 from every single attorney, firm, or vendor before their first payment goes out the door.

Tag Payments Immediately. The moment you cut a check or send a wire, tag it in your accounting software as a 1099-reportable payment. This creates a real-time, accurate list you can pull in seconds.

Conduct Quarterly Reviews. Set aside 15 minutes each quarter to review your tagged payments. This quick check-in is your safety net, helping you catch mistakes or missing information long before they become a crisis. For more on tracking payments, check out our guide on how a retainer works with a lawyer.

By making 1099 compliance a consistent workflow, you shift it from a high-stakes annual project to a low-stress, manageable task. You have the data you need, when you need it, without the last-minute panic.

This proactive approach not only keeps your firm compliant but also frees up your time to focus on what actually matters—serving your clients and growing your practice.

Common Questions About 1099s for Attorney Fees

Even with a solid process, a few tricky situations always pop up. Let’s cut through the confusion with straight answers to the questions I hear most often from law firm owners about their 1099s.

Do I Have to Issue a 1099 to an Incorporated Law Firm?

Yes, you absolutely do. This is one of the biggest points of confusion.

Normally, you don't have to send 1099s to corporations. But payments for legal services are the big, glaring exception to that rule. If you pay another law firm—even a C-Corp or S-Corp—$600 or more for legal services, you must send them a Form 1099-NEC. The IRS is very clear on this.

What Happens If I Forget to File a 1099 for an Attorney?

Forgetting to file can get expensive. The penalty starts at $60 per form if you’re just a little late (within 30 days of the deadline) and climbs quickly from there. If the IRS believes you intentionally ignored the requirement, the penalties get significantly steeper. It’s always best to file as soon as you realize your mistake.

Does This Apply to Court-Awarded Attorney Fees?

Yes, it does. Where the money comes from doesn't change your reporting responsibility.

If a defendant is ordered by a court to pay your firm's legal fees directly, they are the payer. That means they have to issue a Form 1099 to your firm for that payment, as long as it hits the $600 threshold. The rules apply whether the money comes from a settlement check or a direct court award.

Managing 1099s is just one piece of the operational puzzle. A smooth operation really starts with your client intake, because a messy intake almost always leads to messy financial tracking later on. This is where modern client intake software for law firms can make a huge difference.

intake.link brings signatures, payments, and client forms together into one simple, streamlined flow. It helps you capture all the data you need correctly from the very first interaction, making tax time a whole lot easier. See how a unified workflow can replace your scattered tools.