Losing a great client because they can't pay a huge retainer upfront is a painful, avoidable problem. Offering a payment plan is often the single factor that gets a hesitant lead to sign with you instead of your competitor.

Yes, lawyers accept payment plans—or at least, the smart ones do. It's one of the most powerful tools for winning over a new client stuck choosing between two great firms. The firm that makes its services financially accessible is almost always the one that gets the signature, especially since leads contacted within 5 minutes are 21x more likely to convert. For a deep dive into turning leads into clients, check out our guide to Stop Losing Leads Faster.

Why Payment Plans Are a Competitive Advantage for Your Firm

Offering payment plans isn't about being generous—it's a sharp business move that directly impacts your bottom line. When you ditch the giant, upfront retainer as the only option, you immediately open your doors to a wider pool of qualified clients who might have otherwise walked away.

This simple shift reframes your services from an intimidating expense into a manageable investment. Modern clients expect this flexibility. Data from Clio's Legal Trends Report shows that firms using flat fees—often broken into installments—collect payment nearly twice as fast as hourly billers. That's a massive boost to your cash flow.

Gain More Clients, Improve Cash Flow

To put it plainly, here’s what happens when you implement payment plans:

- You convert more leads. More potential clients can afford to say "yes" when the financial barrier is lower. You stop losing good cases to sticker shock.

- You create predictable revenue. Instead of waiting for a single lump-sum payment, you build a steady, reliable stream of monthly income. This makes forecasting your firm's finances worlds easier.

This client-centered approach also enhances your reputation. It shows you understand the financial realities clients face, which builds trust and encourages referrals. It’s a strategic decision that pays dividends long after the final payment clears. And to really nail the experience, you should also know the benefits of attorneys accepting credit cards.

Here's a quick breakdown of this powerful strategy.

| Benefit for Your Firm | Direct Client Impact |

|---|---|

| Increased Conversion Rates | Lowers the upfront financial barrier, making legal help more accessible. |

| Improved Cash Flow | Turns unpredictable retainers into a steady, reliable monthly revenue stream. |

| Wider Client Base | Attracts qualified clients who can afford your services over time, just not all at once. |

| Enhanced Reputation | Shows empathy and flexibility, building trust and encouraging referrals. |

| Reduced A/R Headaches | Automated monthly payments mean less time spent chasing down invoices. |

Ultimately, offering payment plans is a win-win. It’s a competitive edge that helps you sign more clients while making your firm's financial health stronger and more predictable.

What Kind of Payment Plans Should Your Law Firm Offer?

Deciding to offer payment plans is the easy part. Picking the right model for your practice area and cash flow is what matters. You need a structure that works for your firm, your clients, and how you bill for services.

Fortunately, three proven models work for just about any small law firm. These are practical tools designed to get you paid predictably while making it easier for clients to say "yes." The goal is to match the payment structure to the legal service you provide.

Flat Fee Installments

This is the cleanest and most popular model. If you handle matters with predictable costs—like an uncontested divorce or a business formation—a flat fee broken into installments is perfect. You take the total fee and divide it into equal monthly payments.

For example, a business lawyer charging a $3,000 flat fee for a contract review can offer three monthly payments of $1,000. This simple move makes the service immediately more affordable and removes the client's fear of a surprise bill.

Installment Retainers

What about cases where you still need to bill hourly, like in complex litigation? An installment retainer is your answer. Instead of demanding a single, intimidating $10,000 retainer upfront, you break it into smaller chunks.

You might ask for $5,000 to begin work, followed by two subsequent payments of $2,500 over the next 60 days. This significantly lowers the initial barrier, allowing clients to get representation without draining their savings. For higher-stakes cases, this flexibility makes all the difference.

The decision to offer a payment plan is often the deciding factor that turns a hesitant lead into a signed client. It transforms the conversation from "Can I afford this?" to "How do we get started?"

Legal Subscription Models

For firms providing ongoing counsel, a subscription model creates the most predictable revenue possible. This is ideal for business clients needing regular advice on contracts or compliance but lack the budget for full-time general counsel.

Instead of billing for every 15-minute phone call, you offer a set monthly fee for a defined scope. A $500/month subscription, for instance, could provide up to five hours of legal consultation. This structure turns you into their go-to advisor while ensuring you get paid consistently.

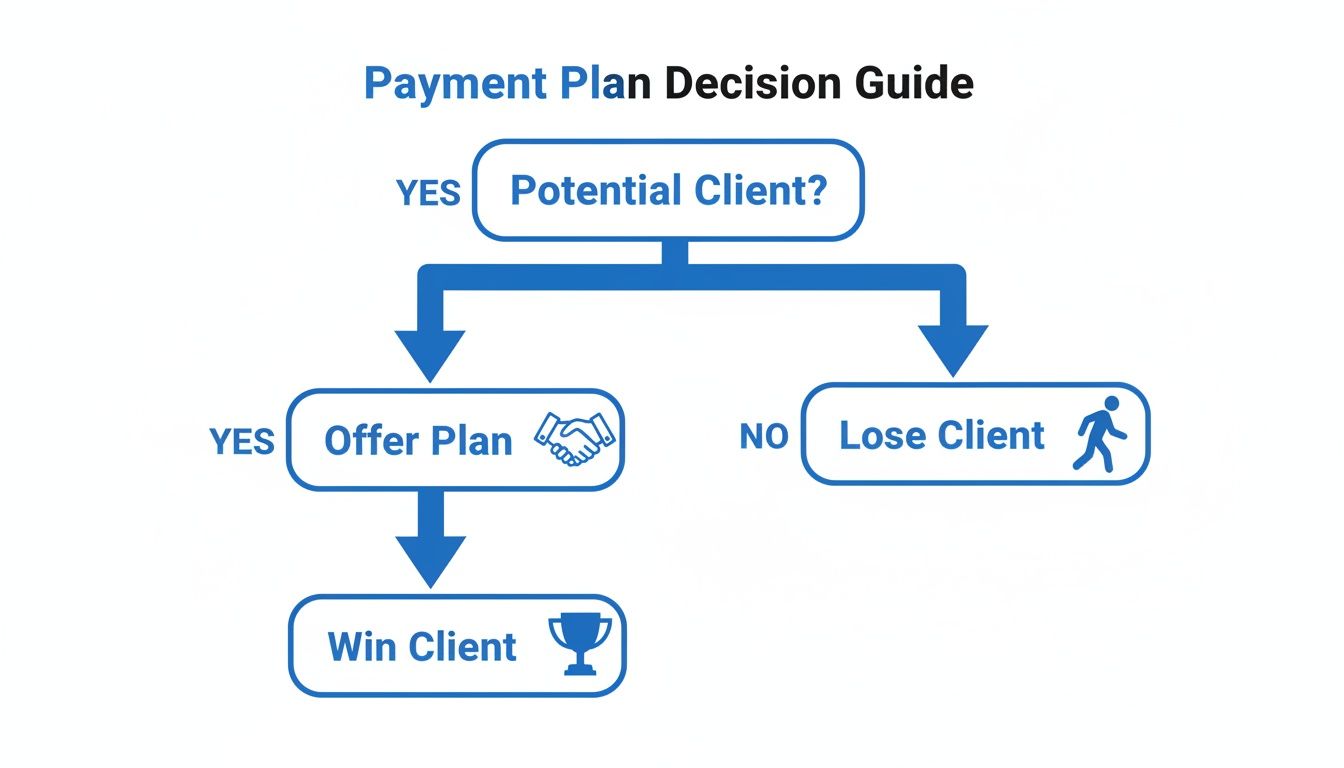

When a potential client is on the line, this decision tree shows just how simple the choice can be.

Ultimately, the flowchart highlights a critical reality for small firms: refusing payment flexibility is often the same as refusing the client.

How to Set Up Payment Plans Without Drowning in Admin Work

Offering payment plans is a great way to land more clients. But for many firms, the idea triggers a migraine—visions of chasing invoices, tracking spreadsheets, and endless administrative follow-up.

Good news: you don’t need a dedicated finance department to make this work. The trick is to stop thinking about it as a manual task.

The secret is building an automated workflow from the moment the client says "yes." A modern, unified system can handle everything from e-signatures to recurring payments without anyone on your team lifting a finger. It turns a high-maintenance chore into a set-it-and-forget-it system.

This isn't a small thing. Attorneys spend 48% of their time on non-billable administrative tasks. Automating payment collection is one of the fastest ways to claw back those hours for actual legal work. That's why building streamlined Operations Systems That Scale is so critical.

The Three Pillars of an Automated Payment System

To build a system that saves time instead of burning it, you need to nail three core components.

- Electronic Signatures: Ditch the print-sign-scan shuffle. Your system must let clients review and sign the fee agreement—with payment terms in plain English—from their phone in minutes, not days.

- Automated Payment Collection: Manually running a card every month is a recipe for mistakes. A proper setup securely stores payment info (with authorization) and automatically charges them on schedule. No chasing, no reminders.

- Centralized Client Data: When a client signs and pays, that action should create a client record in your management software, update their payment status, and sync everything automatically.

Building Your One-Link Workflow

The goal is to give your client a single, simple path to hiring you. Forget sending three separate emails for the agreement, payment link, and intake form. You send one link that handles everything.

Here’s what that looks like:

- You send the client a link to your secure intake portal.

- They review the fee agreement and e-sign it on the spot.

- They enter their payment information once to authorize the recurring plan.

- They fill out any other intake questions you need.

This whole thing can be done before they even hang up the phone with you. It vaporizes the need for follow-up calls, slashes the risk of them getting cold feet, and gets you retained and paid faster than any manual process ever could.

A streamlined system gets the client's commitment right away, preventing them from calling another firm. The right technology, especially a modern CRM built for law firms, rolls these steps into one and puts your collections on autopilot.

Drafting an Ironclad Fee Agreement for Payment Plans

You've decided to offer a payment plan. Great. Now you need to protect your firm with a fee agreement that leaves zero room for confusion. A vague agreement is an open invitation for collection nightmares and ethical tangles.

An ironclad agreement does more than list payment dates. It sets crystal-clear expectations for both you and your client, making them feel secure and far less likely to fall behind. Think of this document as your primary tool for ensuring you get paid for your work.

Key Clauses Your Agreement Must Include

Ambiguity is your enemy. Your payment plan terms must spell out every detail in plain English. Your client needs to know exactly what they owe, when they owe it, and what happens if life gets in the way.

Here are the non-negotiable elements every agreement needs:

- Total Fee and Payment Schedule: State the total amount owed. Then, break it down with exact payment amounts and due dates. For example, "$500 due on the 1st of each month for six months."

- Scope of Work per Installment: Clearly define what legal work is covered by each payment. This justifies pausing work if payments stop and prevents clients from thinking the entire case is covered by the first installment.

- Default Provisions: What happens if a client misses a payment? Spell it out. This could be a short grace period, followed by a pause on all work, and eventually, a motion to withdraw as counsel.

Having a well-defined default clause isn't about being punitive; it's about being professional. It protects your firm from unpaid work and gives you a clear, ethically sound process to follow if a client can't hold up their end of the bargain.

Presenting the Terms to Build Trust

How you present the agreement matters as much as what’s in it. Don’t just slide a dense legal document across the table and point to the signature line.

Take a few minutes to walk your client through the key provisions, especially the payment schedule and default clause. This simple act of transparency is a massive step in building a strong attorney-client relationship. It reinforces their decision to hire you.

For a deeper dive into structuring your contracts, check out this guide to creating a solid legal retainer agreement template.

How to Offer Payment Options to Convert Leads Faster

The moment a potential client decides to hire you, a clock starts ticking. Every second of hesitation gives them a chance to second-guess, get distracted, or call the next firm on their list.

When you can answer the "do lawyers accept payment plans?" question with a "yes" and immediately text a link to a structured plan, you slash your time-to-retainer. What used to take days of back-and-forth now happens in minutes.

Think about it: a single link that bundles your fee agreement, payment options, and intake form eliminates all the usual friction. Clients can sign and pay on their phone, getting you retained before you even hang up the call.

- One-Link Delivery sends the agreement and payment request in one text or email.

- E-Sign Integration lets clients sign in seconds without a printer or scanner.

- Automated Charging sets up recurring payments automatically, so no one has to chase money.

Streamlined Workflow Insights

Imagine a lead clicks your link right after your consultation. They see clear installment options and a simple "Sign & Pay" button. This is critical because research on law firm lead conversion confirms that speed is everything.

Rapid follow-up isn't a nice-to-have—it's a game changer for client capture.

By integrating payment plans into that first touchpoint, you can cut client drop-off significantly. A tool that brings intake and payment together in one step eliminates the email chase and reduces friction.

Actionable Next Steps

- Sign up for a client intake platform that supports one-link signing and payments.

- Customize your fee agreement template to include clear, pre-defined installment terms.

- Test the entire workflow by sending a mock link to yourself. See how fast and simple it is.

- Review your intake analytics weekly to spot where people are dropping off and adjust your terms.

By embedding payment options upfront, you turn a client's intent into a firm commitment—instantly. This frees your team from manual follow-ups, letting them focus on client work. Stop losing leads. Get the signature before they have a chance to call someone else.

Navigating the Ethical Rules for Lawyer Payment Plans

Offering flexible billing is an ethical decision, not just a business one. While no rule prohibits payment plans, you must follow your jurisdiction's guidelines on fees to the letter. This protects your clients, your reputation, and your license.

The bedrock is the ABA’s Model Rule 1.5, which states a lawyer cannot charge an unreasonable fee. At its core, this means any payment plan you create must be fair and transparent from the start.

Fee Reasonableness and Transparency

Your fee agreement is your most critical tool for compliance. It needs to spell everything out in plain language: the total cost, the payment schedule, and exactly what services are covered by each installment. Ambiguity is what gets firms into hot water.

Be especially careful with retainers. Steer clear of unenforceable language like "non-refundable retainer." Most jurisdictions view retainers as earned fees, but the fee must still be reasonable for the work you've promised to do.

Your ethical obligation is to ensure the client fully understands what they are paying for and when. A transparent, well-drafted payment plan agreement is not just good business—it's a requirement to maintain client trust and stay compliant.

Proper Handling of Client Funds

How you handle the money is just as important as the agreement.

- Unearned vs. Earned Fees: Advance payments for future work (unearned fees) must almost always go into a client trust account. As you perform the work, you can then transfer the earned portion into your firm’s operating account.

- Flat Fee Rules: Jurisdictions vary. Some allow you to deposit a flat fee directly into an operating account, but only if your agreement states the client may be entitled to a refund if you don't complete the work.

Always check your local bar association’s rules on fee agreements and trust accounting. They are the final word. A compliant, automated system is key to making this work without creating an administrative headache.

Common Questions About Law Firm Payment Plans

You're not the first firm to ask. Let's tackle the questions we hear most from lawyers considering payment plans.

What Happens if a Client Stops Paying?

Your fee agreement is your first line of defense. It must spell out exactly what happens in a default. Typically, you pause all work on their matter and, if necessary, file a motion to withdraw from representation. Prevention is better: automated payment systems send reminders before a payment is due, dramatically reducing missed payments.

Are Payment Plans Good for Every Practice Area?

They work best in practice areas with predictable costs, like family law, estate planning, and criminal defense, especially with flat fees. But for litigation or hourly cases, you can still offer an installment plan for the initial retainer. This makes it much easier for a client to get started.

How Do I Offer a Plan Without Sounding Desperate?

It's all in the delivery. Project confidence. This isn't a special deal; it's a standard business option, like accepting a credit card. Frame it as one of your firm's flexible payment methods. For instance, state: “We can break the $3,000 flat fee into three monthly payments of $1,000.” That's it. It positions you as a professional, client-focused firm.

intake.link consolidates your entire intake process. Stop losing leads—get signatures before they call another firm by visiting https://intake.link.