Tired of chasing down payments and dealing with cash flow gaps? A properly structured retainer turns a promising lead into a paying client before they have a chance to call another firm, securing your services and your cash flow in one simple step.

Your Quick Guide to Lawyer Retainer Agreements

If you're wrestling with the financial uncertainty of unpaid invoices, you're not alone. The old bill-later model is notorious for creating stressful, non-billable work. For many small firms, this cycle makes it nearly impossible to grow. This is the exact problem a well-structured retainer agreement solves.

Understanding how do retainers work for lawyers is the key to building a stable, predictable practice. A retainer isn't just about getting paid; it’s about formalizing the attorney-client relationship from the first conversation. It sets professional boundaries and manages client expectations on costs and commitment right from the start.

The Foundation of Financial Stability

By securing funds upfront, you instantly slash the risk of non-payment. This simple shift has a massive impact on your firm’s day-to-day operations. It lets you:

- Improve cash flow: With money in your trust account, you can confidently put resources toward a case without waiting weeks for an invoice to clear.

- Filter for serious clients: A client willing to pay a retainer is invested in the outcome and respects your expertise.

- Reduce administrative burdens: You’ll spend far less time on collections. Attorneys already spend 48% of their time on non-billable admin tasks; retainers are a direct way to cut that number down.

By requiring a retainer, you shift from a service provider chasing a debt to a trusted advisor with a secured commitment. It's the most effective tool for financial predictability in your firm.

For any firm navigating legal industry solutions, getting these mechanics right is fundamental. When implemented correctly, retainers become a core part of your firm’s financial strategy and law firm operations. Let's break down the different types and how to manage them.

The 5 Types of Retainer Fees for Your Law Firm

Picking the right retainer model isn't just about getting paid—it's about setting clear expectations from day one. Using the wrong structure creates billing headaches and client disputes. Getting it right ensures predictable cash flow and gives clients the transparency they crave.

A retainer is an upfront payment that secures your services and acts as a down payment. For most common legal matters, clients can expect an initial retainer between $2,000 and $5,000, though this varies widely by practice area. You can see more details on average retainer fees on Haute Living.

Let's break down the five models you can use.

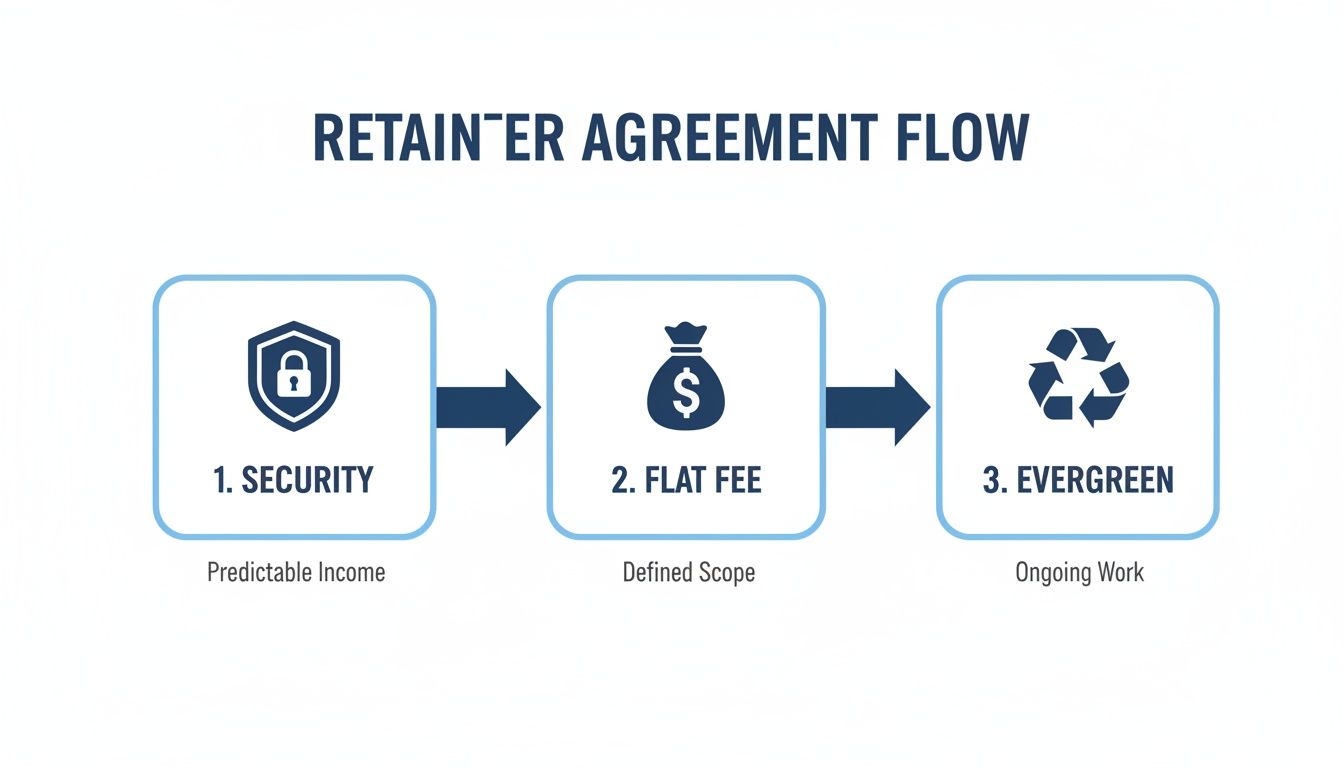

1. Security or Advance Fee Retainer

This is the bread and butter for most firms. The client pays an upfront amount—say, $5,000—which you deposit into your client trust account. As you put in the hours, you bill against that balance, transferring earned funds to your firm’s operating account.

It’s straightforward and works perfectly for cases with unpredictable hours, like litigation or complex family law disputes. The key is keeping the client in the loop with clear, regular invoices showing exactly where their money is going.

2. Flat Fee Retainer

A flat fee is exactly what it sounds like: one fixed, all-inclusive price for a well-defined legal service. This model is a game-changer for predictable, repeatable tasks where you can accurately estimate your time.

- Best Use Cases: Uncontested divorces, simple estate plans, trademark registrations, or basic contract reviews.

- Key Benefit: Clients love the cost certainty. It eliminates the anxiety of watching the clock, which is a powerful tool for converting leads who are terrified of surprise legal bills.

For your firm, it rewards efficiency. The faster you can deliver high-quality work, the more profitable the engagement becomes.

A flat fee shifts the focus from hours billed to value delivered. This positions you as an expert who provides a clear solution for a predictable price.

3. Evergreen Retainer

Think of the evergreen retainer as a smarter version of the standard security retainer. Instead of letting the balance drain to zero, you set a minimum threshold. When the trust account balance drops below that amount, the client is required to replenish it.

For example, you might start with a $10,000 retainer and require the client to top it back up whenever the balance falls below $2,500. This simple mechanism prevents awkward work stoppages and eliminates the dreaded "your retainer is empty" conversation.

4. Contingency Fee

While not a "retainer" in the traditional sense, a contingency fee agreement secures your services without an upfront payment. Instead, you agree to take a percentage of the final settlement or award—typically 33-40%.

This model is used almost exclusively in personal injury, workers' compensation, and other cases where a monetary recovery is the main goal. You only get paid if you win, which perfectly aligns your interests with your client's.

5. Hybrid Retainer

A hybrid model is your secret weapon for cases that don't fit neatly into one box. It lets you mix elements from different fee structures to create a custom solution.

- Example 1: A reduced hourly rate plus a smaller contingency fee. This ensures you get paid for your time while still having a stake in a big win.

- Example 2: A flat fee for initial stages (like discovery) that converts to an hourly retainer if the matter goes to trial.

This approach gives you the flexibility to tailor the fee structure to the specific risks and demands of each case.

Choosing the Right Retainer Model for Your Practice

Deciding on a fee structure isn't a one-size-fits-all decision. The right model depends on your practice area, the predictability of the work, and your clients' expectations. This table breaks down the core options.

| Retainer Type | Best For | How It Works | Key Benefit |

|---|---|---|---|

| Security / Advance | Unpredictable matters like litigation or complex family law. | Client pays upfront into a trust account. You bill hourly against the balance. | Simple to administer and ensures you have funds on hand before work begins. |

| Flat Fee | Routine, predictable services like estate plans or uncontested divorces. | One fixed price for a specific scope of work, often paid upfront. | Clients love the cost certainty, which makes it easier to close leads. |

| Evergreen | Long-term, ongoing cases that require continuous work. | A security retainer that must be replenished when it drops below a set threshold. | Eliminates cash flow gaps and avoids awkward "out of money" conversations. |

| Contingency | Cases with a potential monetary award, like personal injury. | You take a percentage of the final settlement or award. No upfront cost to the client. | Aligns your incentives directly with the client's goal of a maximum recovery. |

| Hybrid | Complex cases with varying stages or uncertain outcomes. | Combines elements, like a reduced hourly rate plus a contingency fee. | Maximum flexibility to create a fair arrangement for unique legal matters. |

The best retainer feels fair to both you and your client. By understanding these five models, you can structure fees that build trust and ensure your firm's financial health.

Understanding Trust Accounts vs. Operating Accounts

If there's one thing that gets lawyers in hot water, it's mishandling client funds. Getting this right is fundamental to keeping your license. At the heart of it all is the strict separation between your trust account and your operating account.

Your client trust account (often an IOLTA account) is a safe deposit box you hold for your client. The money inside belongs 100% to them until you've done the work and sent an invoice. You are merely the guardian of those funds.

Your operating account is your firm’s checking account. It pays for your payroll, rent, and software. Mixing funds between these two accounts is called commingling, and it’s one of the most serious ethical violations a lawyer can commit.

The Flow of Client Funds

How does this work when a new client pays their retainer? Every unearned dollar must go directly into your trust account. This includes advance retainers, flat fees paid upfront, and any settlement funds.

The rule is simple: if you haven't earned it, it doesn't belong to you. Depositing an unearned retainer directly into your firm's operating account is a shortcut to a disciplinary hearing.

You can only move money out of the trust account after you’ve completed the work, sent a clear invoice, and given the client a reasonable chance to review it. Only then can you transfer the exact earned portion to your operating account.

The flowchart below shows how initial funds are handled for common retainer types.

As you can see, no matter the model—security, flat fee, or evergreen—those initial, unearned funds have to be secured in the right place.

From Retainer to Revenue: A Step-by-Step Example

Let's say a new client signs your agreement and pays a $5,000 security retainer. Here’s the compliant workflow:

- Deposit: The entire $5,000 is immediately deposited into your IOLTA/trust account.

- Work: You perform 10 hours of legal work at your rate of $300/hour.

- Invoice: You generate a detailed invoice for $3,000 (10 hours x $300) and send it to the client, stating the payment will be deducted from their retainer.

- Transfer: After a reasonable review period, you transfer exactly $3,000 from the trust account to your firm's operating account. This money is now your revenue.

- Balance: The remaining $2,000 stays in the trust account for the next billing cycle.

This disciplined process is non-negotiable. It ensures you never accidentally use client money to run your business—a mistake that could cost you your career.

Key Clauses Your Retainer Agreement Must Include

Your retainer agreement is the bedrock of the client relationship and your best defense against disputes. A vague contract is an invitation to scope creep, payment arguments, and misunderstandings that drain your time.

Think of your agreement as the script for a clear, upfront conversation that prevents future headaches. Getting this document right protects your firm and sets professional expectations from day one.

Scope of Representation

This is the most critical clause. It needs to define, with absolute clarity, what you will do and, just as importantly, what you will not do. Don't just write "representation in divorce proceedings."

Get specific about the exact tasks included.

- Good Example: "This representation covers the drafting and filing of the initial petition for dissolution, discovery, and negotiation of a marital settlement agreement. It does not include litigation, appeals, or any post-judgment modifications."

That level of precision shuts down client assumptions and is your single best tool against scope creep.

Fee Structure and Billing Rates

Never leave room for interpretation here. The agreement must clearly state your hourly rate, rates for associates or paralegals, and a list of billable costs like filing fees. If you're using a flat fee, define the exact service it covers.

This transparency builds immediate trust and stops billing disputes before they start. You can find more examples in this helpful guide to crafting a legal retainer agreement template.

Replenishment Clause

For evergreen retainers, this clause is non-negotiable. It automatically triggers a request for more funds when the client’s trust account balance drops below a specific threshold. This is crucial for preventing work stoppages and saves you from chasing payments mid-case.

For instance, a $10,000 initial deposit might require a top-up whenever the balance falls below $2,500. This is especially important when you consider that 71% of clients prefer predictable flat fees over hourly billing. Best Lawyers offers more insights on fee predictability.

A strong retainer agreement isn’t about mistrust; it’s about creating mutual understanding. It ensures both you and your client are playing by the same rules.

Communication and Termination

Finally, your agreement needs to set expectations. Outline how you'll communicate—like your policy on response times—and the conditions under which either party can end the relationship.

A clear termination clause explains how final fees will be calculated and how any unearned retainer funds will be promptly returned. This gives everyone a clean exit strategy if the relationship sours.

How to Bill Against a Retainer and Handle Refunds

This is where the rubber meets the road. Get your billing process right, and you build incredible client trust. Get it wrong, and you’re staring down a bar complaint. Your system must be transparent, compliant, and easy to manage.

It all starts with obsessive time tracking. Every billable task needs to be recorded accurately, then translated into an invoice a non-lawyer can understand. Your invoice must clearly show the work done, the charge, how much was deducted from the retainer, and the new remaining balance.

Generating Invoices and Drawing Funds

Once the work is done and you've sent a detailed invoice, give your client a reasonable time to look it over. Only after they've had a chance to review it can you transfer the exact earned amount from your IOLTA trust account into your operating account. Never transfer the money before sending the invoice.

This workflow is non-negotiable for compliance. The average lawyer's hourly rate has climbed to $349, yet solo attorneys often bill just 2.6 hours a day. You can discover more insights about law firm rates to see why making every billed minute count is so critical.

Managing Retainer Refunds Correctly

What happens when the case is over with money still in the trust account? You are ethically bound to promptly refund every penny of the unearned portion. It's the client's money until you've earned it. Period.

The refund process must be just as disciplined as your billing:

- Finalize Billing: Create one last invoice covering all outstanding work up to the termination date.

- Calculate the Balance: Determine the exact unearned amount left in the trust account.

- Issue the Refund: Immediately return the remaining balance to the client, directly from the trust account. Do not move it to your operating account first.

A slow or incorrect refund is one of the fastest ways to get a client's attention—and a bar association's. Treat returning unearned funds with urgency.

Trying to manage these transfers by hand is a recipe for mistakes. If you're wondering how modern payment methods fit in, you can learn more about whether lawyers can accept credit cards for retainers. The right system ensures you get paid on time while keeping everything by the book.

Stop Chasing Paperwork: Streamline Your Retainer Process

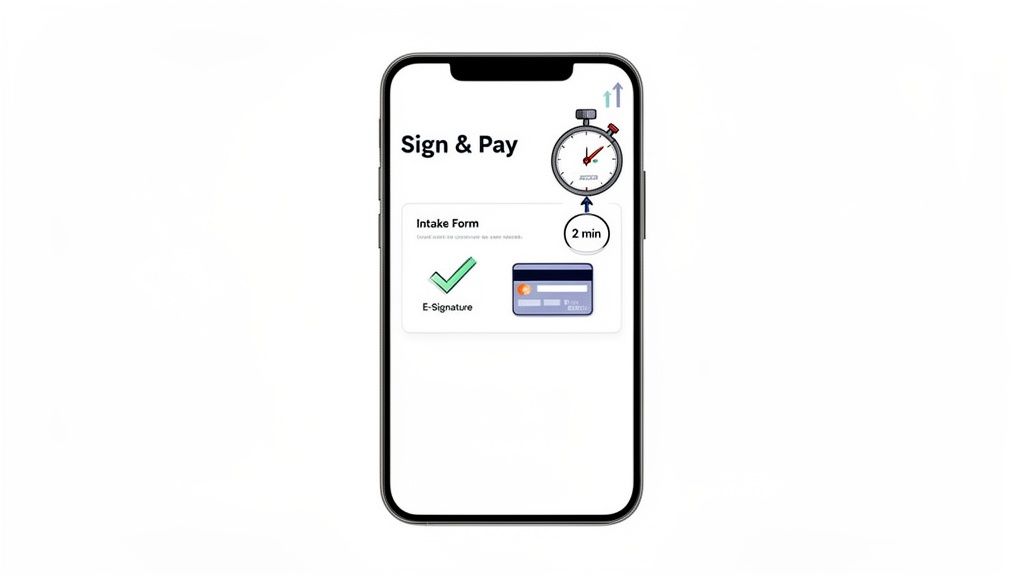

Every manual step in your retainer process is a leak in your pipeline. When you email a PDF, wait for a signature, then circle back for a credit card number, you give a committed prospect time to have second thoughts. Leads contacted within 5 minutes are 21x more likely to convert.

That gap between a client saying "yes" and you getting a signed retainer with payment is where good leads go to die. It’s an administrative dead zone that’s costing you money, especially when attorneys already spend 48% of their time on non-billable administrative work.

From Hours to Minutes: The Modern Retainer Workflow

The old way of handling retainers is a multi-step, multi-tool mess: you email a PDF, the client prints and scans it, then you chase them for payment info. This can drag on for days.

A modern, automated workflow bundles everything into one seamless action. You send a single link that lets a client fill out their intake form, sign the retainer electronically, and pay their deposit—all in about two minutes on their phone. This is the cornerstone of an effective client onboarding process and a key step in getting faster conversions.

By turning your retainer process into a one-step action, you close the deal before the client gets distracted. Speed isn't a convenience; it's your most powerful conversion tool.

To truly leave the paperwork chase behind, a modern firm also needs solid law firm IT support that can manage risk and keep your systems efficient. When your tech works seamlessly, you can finally focus on billable work instead of administrative headaches.

Answering Client Questions About Retainers

Even with a clear agreement, clients will have questions. How you answer can either build confidence or create doubt. Be prepared to address these common questions with clarity.

What Happens If the Retainer Runs Out?

That’s a great question, and we plan for it. Our agreement includes an “evergreen” clause. If work on your case brings the retainer balance below a specific amount we’ve agreed on, this clause requires you to top it back up. This system keeps things running smoothly so we can focus on your case without awkward pauses.

Are Retainer Fees Refundable?

It depends on the type of retainer. We typically use an advance-fee retainer, where any unearned funds are kept in a special trust account. If your case wraps up early or our work ends for any reason, whatever is left in that account is always refundable to you.

The only time a retainer isn’t refundable is with a “classic” retainer, which is much rarer. That’s a fee paid just to guarantee my availability. We'll always be upfront about which type applies to your case.

How Do I Ask a Client to Replenish Their Retainer?

We take the human element out of it. Instead of us having to call you, our billing system sends an automatic low-balance notification when the retainer hits the agreed-upon threshold. It’s not a personal request; it’s a professional, automated reminder based on the agreement, which keeps things transparent.

Can I Pay My Retainer with a Credit Card?

Yes, and we encourage it. But there’s a critical detail: the payment has to be processed correctly to comply with state bar rules. When you pay a retainer, the funds must go directly into a special IOLTA-compliant trust account, not our firm's operating account. We use a payment processor designed for law firms that makes this distinction, because using a generic system like PayPal or Venmo is a recipe for compliance headaches.

Stop losing leads—get signatures before they call another firm. intake.link consolidates your entire intake process into a single, two-minute experience. See how it works.