Stop chasing checks and losing clients to faster firms. If you aren't accepting credit cards, you're making it harder for clients to hire you and strangling your firm's cash flow. The data is clear: clients expect modern payment options, and providing them is a competitive necessity.

The answer to "do lawyers accept credit cards?" is a resounding yes—the successful ones do. They understand that making payments easy is a critical part of a smooth client intake process. In fact, 67% of clients choose the first firm that responds professionally, and instant payment is a huge part of that impression. Learn more in our complete guide to law firm client intake.

Why Credit Card Payments Are a Must-Have for Your Firm

Think about how your clients pay for everything else in their lives. They expect fast, simple, and digital options. Forcing them to mail a check creates unnecessary friction at the exact moment they’re ready to retain you.

Every manual step you add—finding a checkbook, addressing an envelope, driving to the post office—gives a potential client time to second-guess their decision or call the next attorney on their list. This isn't just an inconvenience; it's a conversion killer.

The Real Cost of Resisting Digital Payments

The numbers paint a clear picture. By not offering online payments, you are willingly alienating a huge slice of your market. Research shows 40% of consumers would never hire a lawyer who didn't offer this basic option.

It's not just about getting clients in the door, either. It’s about getting paid. Firms that accept credit cards get their invoices paid 40% faster on average, which can completely change the cash flow dynamics of your practice. You can find more data on this in an excellent breakdown of law firm payment trends on leanlaw.co.

How Payment Methods Impact Your Firm's Efficiency

For a small firm owner, the daily reality of getting paid looks wildly different depending on the tools you use. This isn't a minor detail; it's a fundamental choice that impacts your time, revenue, and client satisfaction.

| Metric | Checks and Invoices | Integrated Credit Cards |

|---|---|---|

| Speed to Pay | Days or weeks | Instant |

| Admin Work | Manual entry, bank runs, chasing | Automated, instant notifications, less nagging |

| Client Experience | Clunky and inconvenient | Simple, modern, and reassuring |

| Conversion Risk | High drop-off while they "think" | Low; client is secured immediately |

The choice is obvious. One path is filled with friction, delays, and lost opportunities. The other is built for speed, securing clients and revenue in minutes, not weeks.

How Accepting Credit Cards Transforms Your Firm's Cash Flow

Waiting 30, 60, or even 90 days for a check to arrive is a cash flow nightmare. It’s a reality that forces too many small firms to live on a line of credit, constantly stressed about making payroll.

Accepting credit cards isn't just a client convenience; it's a powerful tool that stabilizes your firm’s financial health. You shorten your payment cycle from weeks to minutes, giving you predictable revenue to cover expenses without the anxiety.

This shift has a direct, measurable impact on your bottom line. Law firms using online credit card payments collect 33% more revenue on average and get paid four times faster than firms stuck with paper invoicing. While check-based firms struggle with collection rates around 86-89%, firms that adopt digital payments consistently hit 91% or higher, as detailed in Clio's industry report.

Eliminate Accounts Receivable Delays for Lawyers

Every dollar sitting in accounts receivable is a dollar you can't use. When a client mails a check, you're at the mercy of the postal service, bank processing times, and simple procrastination. This creates unpredictable cash flow gaps.

Instant credit card payments solve this. The money from a paid invoice or an initial retainer is typically in your bank account within 1-2 business days. This consistency transforms your financial operations from reactive to proactive, freeing you from the black hole of chasing payments. If you want a clearer picture of how this fits into your firm's financial health, it's worth understanding accounts payable and accounts receivable.

By collapsing the time between billing and payment, you stop acting like a bank for your clients. You have the capital on hand to invest back into your firm's growth—whether that's hiring a paralegal or increasing your marketing spend.

Boost Your Collection Rate with Easier Payments

It’s a simple truth: the easier you make it for someone to pay you, the more likely they are to do it.

When a client receives an invoice they can pay with one click from their phone, they often do it right then. When they have to find a checkbook, that invoice gets put on a to-do list that’s easy to ignore.

This reduction in friction minimizes the need for awkward follow-up calls and saves your staff hours of non-billable time. This is especially true for securing retainers, which are the lifeblood of many practices. You can learn more about locking down these crucial upfront payments in our guide on how retainers work for lawyers.

Navigating Ethics: Can Lawyers Accept Credit Cards Safely?

The biggest reason lawyers have historically shied away from credit cards isn't the cost—it's the fear of violating ethics rules. But that anxiety is a relic of a time before modern, legal-specific payment systems were built to solve this exact problem.

The core ethical mandate is simple but critical: you cannot mix unearned client funds with your firm's earned revenue. A client’s $5,000 retainer must land in a dedicated trust or IOLTA account. An invoice payment for work you've already completed goes into your operating account. This separation is non-negotiable.

Why Generic Payment Tools Are a Compliance Trap

This is precisely why you can't just use a standard PayPal, Venmo, or Square account. These platforms are designed for retail, not law firms. They deposit all incoming funds into a single bank account, instantly commingling funds and putting you in violation of ethics rules.

It gets worse. These platforms often deduct their processing fees directly from the transaction. If a client pays a $5,000 retainer and only $4,850 hits your account, you’ve just improperly used client funds to pay your firm's business expenses. That's a huge problem.

Key Takeaway: You must be able to direct payments to the correct bank account—trust or operating—and ensure that all processing fees are debited only from your firm's operating account. Standard payment tools can't do this.

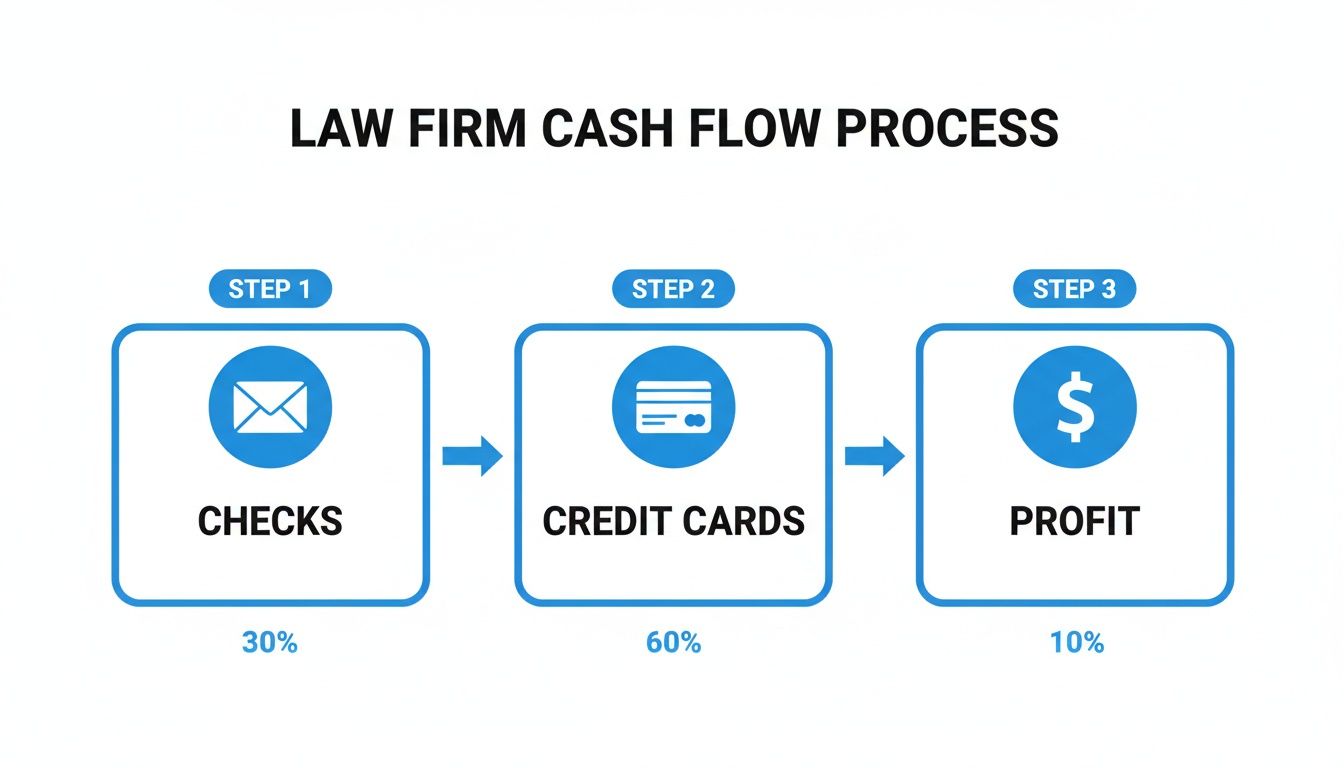

Upgrading from outdated payment methods isn't just about convenience; it's about improving your firm's entire financial workflow.

As this shows, embracing credit cards the right way is a direct line to better cash flow, getting you paid faster and improving profitability.

How Legal-Specific Tools Solve the Trust Account Problem

So, can lawyers accept credit cards ethically? Yes, and the answer lies in using a payment processor built specifically for the legal industry. These systems are designed with IOLTA compliance at their core.

Here’s how they keep your firm safe:

- Automatic Fund Routing: You designate whether a payment request is for a retainer (trust) or an invoice (operating). The system automatically routes the money to the correct bank account. No guesswork, no manual transfers.

- Fee Protection: The processor intelligently deducts all transaction fees exclusively from your linked operating account. The full, original amount of any client payment always lands intact in the designated trust or operating account.

- Clear Recordkeeping: You get clean reports documenting every transaction. The records clearly show which account received the funds and how fees were handled, giving you a perfect audit trail.

Using tools built for lawyers offloads the heaviest compliance burdens. The technology manages the complex routing and fee accounting, letting you offer the payment options clients expect without putting your license on the line.

Are the Processing Fees Worth It for a Law Firm?

It's the first question every firm owner asks: what about the processing fees? Giving up 2-3% of your revenue can be a tough pill to swallow. But looking at this as a "cost" is a mistake.

Think of it as an investment in landing clients and fixing your cash flow. The real expense isn’t the fee; it’s the time your team wastes chasing checks and the clients you lose to competitors who make it easy to pay.

The True Cost of a $5,000 Retainer

Imagine you’ve landed a new client who needs to pay a $5,000 retainer. You have two options: insist on a check or let them pay instantly with a credit card.

Option A (Check): You save $150 (a typical 3% fee). But the client says they’ll "drop it in the mail." A week goes by. Two weeks later, you’re still waiting, the client's urgency is fading, and you've sunk non-billable hours into chasing payment. The risk of them calling another firm goes up every day.

Option B (Credit Card): You pay a $150 fee. In return, the $5,000 retainer is secured, and the money is in your bank account within days. The client is officially on board, work begins immediately, and you’ve sidestepped all the administrative headaches.

Which option is truly more expensive? That $150 tax-deductible fee is pocket change compared to losing a $5,000 client or burning hours on administrative churn. Paying the fee isn't a loss; it's an investment to lock in revenue. For more on structuring these payments, see our breakdown of the average retainer cost for a lawyer.

When a client is ready to hire you, your only goal should be to make it as easy as possible for them to give you money. The processing fee is the small price you pay for speed, certainty, and a better client experience.

Of course, you should still manage the expense. It’s worth investigating the most cost-effective options by comparing the cheapest credit card processing services to find a provider that balances low rates with the essential, legal-specific compliance features you need.

The Smart Way to Get Paid: Unify Intake, Signature, and Payment

Knowing why you should accept credit cards is easy. The key is how you implement it.

The most effective strategy is to weave payment collection directly into your client intake process. Stop treating "getting paid" as an awkward, separate step. Make it the final, seamless part of a new client officially hiring your firm.

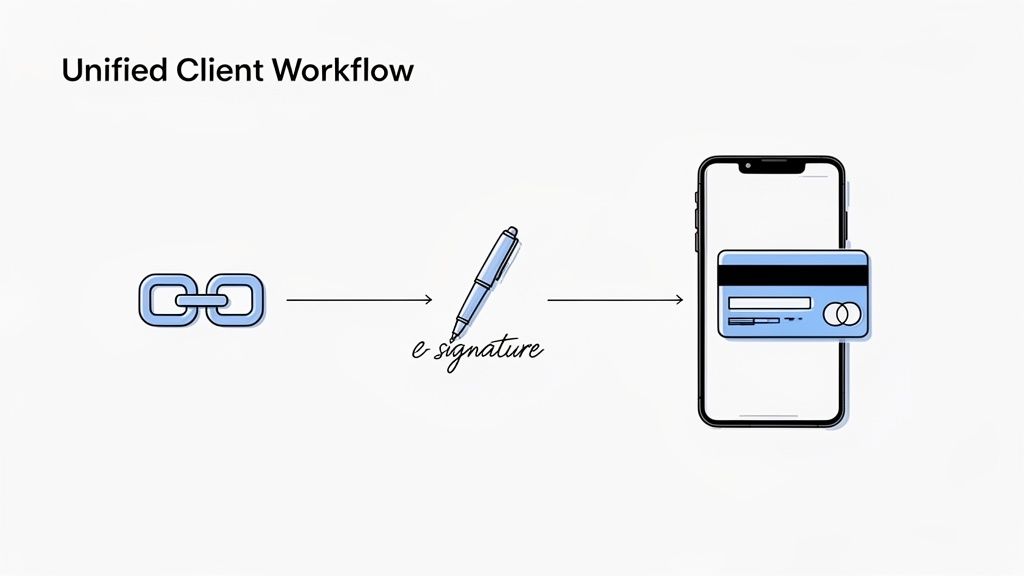

This is about creating one unified workflow. Instead of sending three different emails for an intake form, a retainer agreement, and then an invoice, you send one simple, secure link.

The old way creates friction. A potential client signs your retainer agreement, and then waits for an invoice. This gives them hours or days to get a callback from another attorney who makes it easier to get started. Leads contacted within 5 minutes are 21x more likely to convert, and a unified workflow makes that speed possible.

From Inquiry to Paid Client in One Motion

The modern, client-winning approach collapses that timeline from days into minutes. A prospect gets a single, mobile-friendly link that walks them through three steps in one continuous flow:

- Complete the Intake Form: They provide their information quickly on their phone or computer.

- Sign the Retainer: They review and e-sign your engagement letter on the spot. No printing, no scanning.

- Pay the Retainer: The final screen immediately prompts for their credit card information, securing their payment and commitment instantly.

This unified process is a powerful conversion tool. It capitalizes on the client's peak intent—that precise moment they’ve decided you're the right lawyer.

This visualizes how all those separate steps get folded into a single path that gets you hired and paid before the client can get distracted.

By combining intake, signatures, and payments, you make a powerful first impression. You’re not just another law firm asking for paperwork; you're a modern practice that respects their time. This is how you win business before your competition responds.

This is the difference between chasing leads and locking them in.

Your 3-Step Plan to Start Accepting Credit Cards

Ready to stop chasing checks? Getting set up to accept credit cards is simpler than you think. You can make this critical upgrade to your practice in a single week.

Let's break it down into three actionable steps to get you from "we should do that" to "we're getting paid instantly."

Step 1: Choose a Legal-Specific Payment Processor

First, you need the right tool for the job. For a lawyer, that means a payment processor built for the legal industry. This is non-negotiable.

Generic tools like Square or PayPal are a minefield for attorneys because they aren't designed to handle the separation between your operating and trust funds. Using them risks commingling funds, which can jeopardize your license.

A legal-specific processor understands IOLTA rules. It automatically directs money to the right place—earned fees into your operating account and retainers into your trust account. Crucially, it also ensures that processing fees are only debited from your operating account, leaving client funds untouched.

Step 2: Update Your Fee Agreement

With your payment system chosen, the next step is updating your fee agreement. You need to get your new payment policies in writing for total transparency with your clients.

Your agreement should clearly state that:

- You accept credit card payments for both invoices and retainers.

- All payments run through a secure, PCI-compliant system.

- You can also spell out any rules around recurring billing for payment plans.

This small update sets clear expectations from day one and formalizes the modern experience you're now providing. Proactively addressing payments is a cornerstone of a smooth client onboarding process.

Step 3: Make Online Payment Your Default Process

Finally, put your new system to work. Don't just make credit card payments an option—make it the obvious, easy choice for every client.

Add a prominent "Pay Online" button to your website, your invoices, and your email signature. Most importantly, train yourself and your team to frame it as a benefit. Instead of, "We'll send you an invoice," shift to a confident, "To make things easy, you can finalize the retainer right now with a credit card, and we can get started on your case immediately."

This simple change in language transforms payment from a chore into the final, decisive action that secures a new client on the spot.

Common Questions About Law Firm Credit Card Payments

Let's run through the questions that pop up most often when firms modernize their payment systems. Here are the straight-to-the-point answers you need.

Can I pass credit card fees on to my clients?

This depends on your state's specific ethics rules. Some jurisdictions allow "surcharging," but many either forbid it or have very strict disclosure rules.

Honestly, even where it's allowed, it's often not worth the potential damage to the client relationship. The best approach is to treat the 2-3% processing fee as a standard cost of doing business—just like your office rent. It's a tax-deductible expense, and the dramatic improvement in cash flow makes it a fantastic investment.

What happens if a client disputes a charge?

Chargebacks are a manageable risk. Your best defense is a properly signed retainer agreement.

When you use a modern payment processor, you can respond directly to disputes by uploading the signed agreement. Better yet, if you use a system where the client signs and pays in one seamless flow, you create an incredibly strong link between the agreement and the payment, making it much easier to win a dispute.

How do I keep my client's payment data secure?

This is the most important rule: never write down or store credit card numbers yourself. There is no reason to take on that risk.

A PCI-compliant payment processor like Stripe handles all the heavy lifting of security and encryption. When a client pays through an integrated platform, their card details are sent directly to the processor’s secure servers. Your firm never touches the sensitive data, which removes the security burden from your shoulders.

See how intake.link consolidates your entire intake process. It combines signatures, payment, and intake forms into a single, secure link. Stop losing leads—get retainers signed before they have a chance to call another firm.