Losing good clients because they can't pay a massive retainer upfront is a huge, unnecessary leak in your firm's revenue. Offering payment plans isn't just a client convenience—it's a critical tool for signing more clients before they call your competition.

The short answer is yes, many modern attorneys accept payment plans, and for a simple reason: it's smart business. In a world where clients expect consumer-friendly options, flexible payments are no longer a "nice to have." They're a competitive necessity that directly impacts your ability to stop losing leads and achieve faster conversions.

Why Offering Payment Plans Is a Must-Do for Small Firms

Still on the fence? Every time a qualified lead hangs up after hearing your retainer fee, you've lost revenue. Offering payment plans isn't about discounting your services; it's about making them accessible so you can sign more of the leads you're already generating.

Client expectations have shifted permanently. They want predictable costs, and that trend is reshaping legal billing. A recent report found that a staggering 71% of clients prefer a flat fee for their entire case. This is a massive opportunity for your firm.

Firms that embrace this by combining flat fees with installment plans get paid faster. The same report shows they are nearly twice as likely to get paid almost immediately compared to firms stuck on the old hourly model. You can see all the data in Clio's 2024 Legal Trends Report.

Expand Your Client Base Without Spending More on Marketing

When you break down a significant cost into manageable monthly payments, you instantly open your doors to a wider pool of qualified clients. We're not talking about clients who can't afford you; we're talking about responsible people who don't have thousands in cash just sitting around.

More signed clients means more predictable revenue for your firm. A flexible payment option can be the single factor that turns a hesitant prospect into a signed client, boosting your conversion rate overnight.

Payment Plans at a Glance: Pros vs. Cons for Your Firm

Deciding to offer payment plans means weighing the obvious benefits against the administrative work. It’s a trade-off, but with the right systems, it’s almost always worth it for a growing firm.

Here’s a quick breakdown to help you see the full picture.

| Pros (Why You Should Offer Them) | Cons (Risks to Manage) |

|---|---|

| Attract More Clients Makes your services accessible to a wider market. |

Increased Admin Work Requires tracking installments and following up. |

| Improve Conversion Rates Reduces friction for clients ready to sign. |

Potential for Late Payments Carries a risk of clients defaulting on payments. |

| Create Predictable Revenue Establishes a steady stream of monthly income. |

Cash Flow Delays You receive funds over time, not all at once. |

While the "cons" look intimidating, modern tools can automate nearly all the tracking and follow-up, significantly reducing the administrative burden. The upside—a larger client base and higher revenue—is simply too big to ignore.

What Payment Plan Models Work Best for Law Firms?

Let's be direct: the wrong payment structure can cripple your firm’s cash flow. The right one becomes a competitive advantage. Picking the right model isn't just about getting paid; it’s about matching the payment schedule to the case type so clients get flexibility without putting your firm at risk.

For straightforward, predictable work—like an uncontested divorce or a basic entity formation—a standard installment plan is your best bet. You set a flat fee, say $6,000, and break it into simple monthly payments. This clarity is a huge relief for clients who are already stressed.

Evergreen Retainers for Complex, Ongoing Cases

What about complex cases where you can't predict the hours? This is where the evergreen retainer is your best friend. Instead of one massive upfront payment, the client's retainer is automatically replenished whenever the balance dips below an agreed-upon threshold.

This model protects your firm by ensuring you always have funds to work against. It eliminates chasing payments mid-case and is perfect for litigation, ongoing corporate counsel, or any matter where the scope could expand.

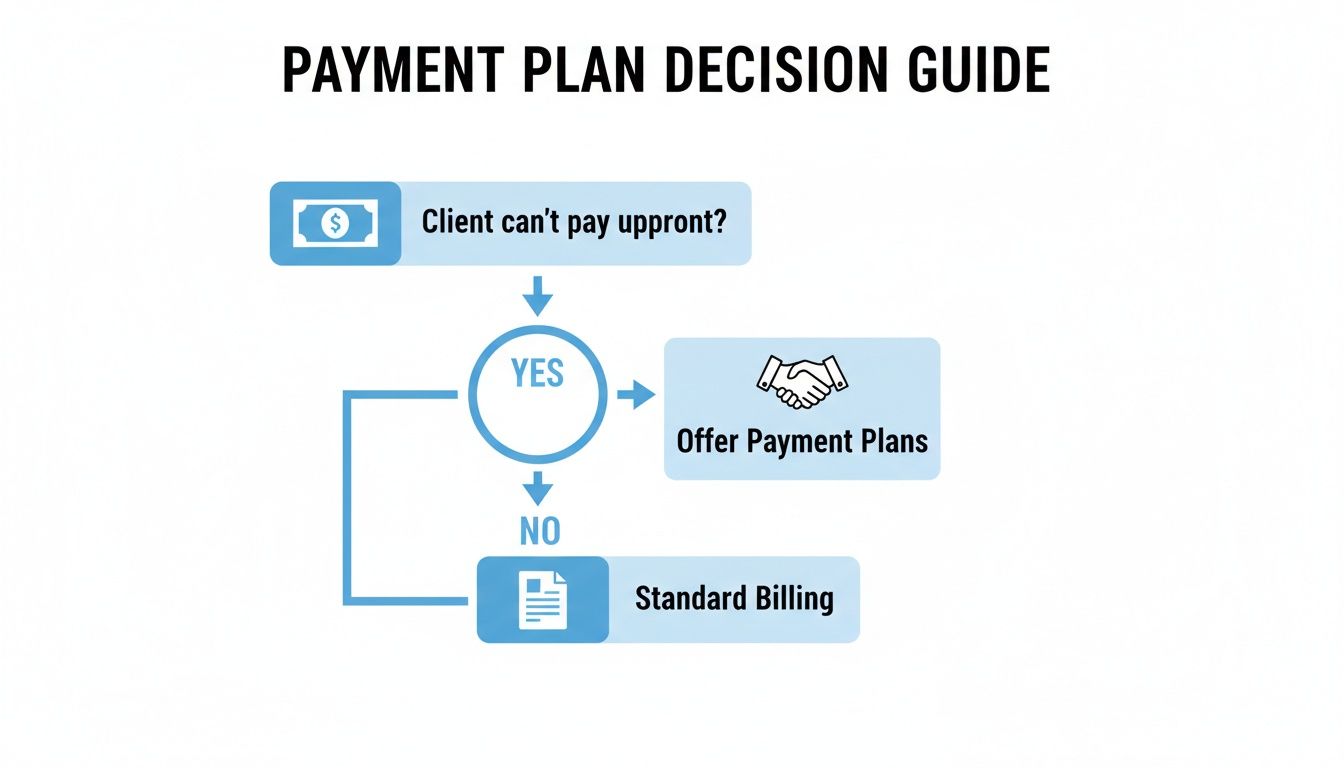

This simple decision tree can help you visualize when to offer a payment plan.

The takeaway is simple: offering payment flexibility isn't just a courtesy. It’s a strategic move that directly expands the pool of clients who can afford to hire you.

Finding the Right Hybrid Approach for Your Firm

You don't have to stick to just one model. A hybrid approach works wonders for many small firms. For instance, require a larger initial payment to cover immediate costs and court fees, then switch to smaller monthly installments for the remaining balance. This gives you security upfront while still offering the client a manageable path.

It also helps to see what others are doing. Take a moment to explore different pricing models and see how other service providers structure their fees. You might find a setup that gives your firm a competitive edge.

The goal isn't just to get paid—it's to create a payment structure so seamless and clear that it becomes a reason clients choose you over another firm.

Ultimately, the best model is one you can manage efficiently. Before offering any plan, ensure you have the right systems in place. You need a way to track payments, send automated reminders, and handle missed installments. Without a solid operational backend, even the best-designed plan becomes an administrative nightmare.

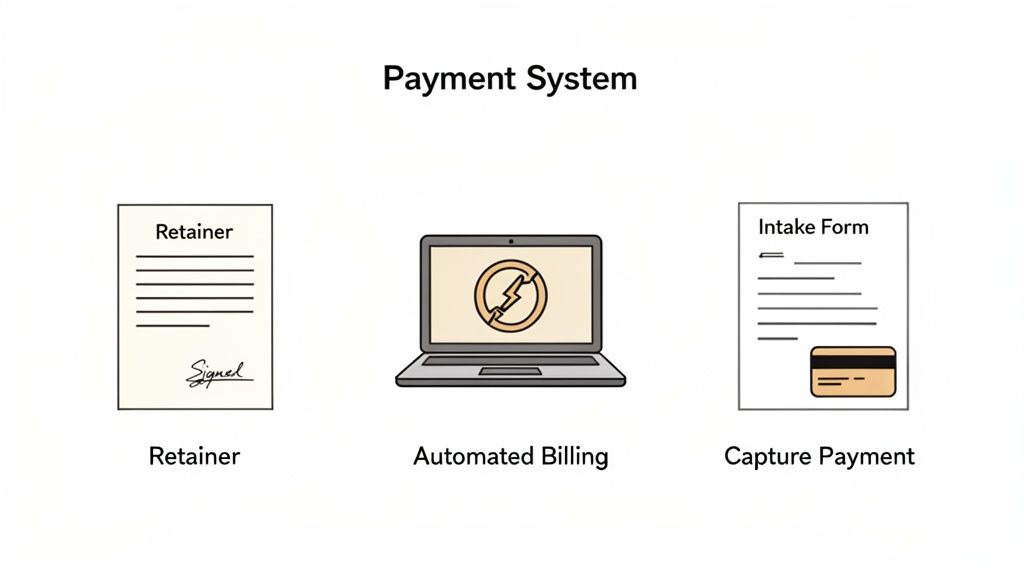

How to Build a Payment System That Protects Your Firm's Cash Flow

For most small firms, the biggest fear isn't doing the legal work; it's chasing payments after the work is done. An effective payment system isn't just about offering options—it's about building an operational framework that ensures you get paid on time, every time.

Get this right, and you turn payment plans from a cash flow risk into a predictable revenue stream.

The key is to stop treating payments as an afterthought. You must bake payment collection into your client intake process by capturing payment details before you start the work. This single shift in your operations eliminates awkward follow-up calls and helps you reclaim some of the staggering 48% of time attorneys waste on non-billable admin tasks.

Draft an Ironclad Retainer Agreement

Your retainer agreement is your first line of defense. It must be crystal clear about when and how you get paid, leaving zero room for interpretation. A vague agreement is an open invitation for late payments.

Your agreement must explicitly spell out:

- The total fee or initial retainer amount.

- The exact payment schedule, including specific due dates.

- The required down payment that must be paid before any work begins.

- Clear consequences for late payments, like a specific late fee or interest charge (check your state bar's rules on this).

This document is more than a formality; it's a tool for setting client expectations from the very first conversation.

Leverage Technology for Automated Billing

Manually sending invoices and chasing late payments bleeds billable hours. Modern payment technology automates this entire workflow. An automated system handles everything from sending initial invoices to processing recurring credit card or ACH payments.

A system with recurring billing automatically charges the client’s saved payment method on the agreed-upon dates. If a payment fails, the system can instantly notify both of you, kicking off follow-up without manual effort. See how a CRM software and QuickBooks integration can make your financial tracking effortless.

The goal is to build a system where getting paid is the default. Automation ensures payments happen on schedule, protecting your cash flow and freeing you to practice law.

Set Firm Policies and Stick to Them

Finally, your payment system is only as strong as your policies. Decide upfront who qualifies for a payment plan and what your standard terms are. This isn't something to figure out on a case-by-case basis.

Establish clear, written policies on:

- Who Qualifies: Are plans available for all case types or only specific ones?

- Down Payment Requirements: Set a minimum percentage or flat fee required to start.

- Maximum Payment Term: Decide the longest duration you'll allow (e.g., six months, one year).

These policies provide consistency and remove guesswork. Combine them with a rock-solid retainer and automated billing, and you create a system that makes payment plans a strategic advantage, not a financial gamble.

Navigating Attorney Payment Plans and Ethical Rules

Offering a payment plan isn't just a business decision—it's governed by strict ethical rules that can trip up even the most careful firm. Getting this wrong doesn't just lead to fee disputes; it can put your license on the line.

The American Bar Association’s guidelines are a start, but the rules you must follow come directly from your state bar. Before you offer an installment option, you need a rock-solid grasp of your jurisdiction's rules on fee agreements, client communication, and handling client funds.

Written Fee Agreements Are Non-Negotiable

Your best defense is an ironclad written fee agreement. When a client pays over time, ambiguity is your worst enemy. That agreement must spell out the total fee, the exact payment schedule, and what happens if a payment is missed.

Your agreement must clearly detail:

- Interest or Late Fees: Can you charge them? If so, how much is allowed? Your state bar has specific rules on this.

- Trust Account Management: How will you handle recurring payments into your IOLTA? You need a clear process to ensure funds are managed correctly and that credit card fees are drawn from your operating account—never from client trust funds.

Global Rules Show Why Details Matter

Payment structures vary wildly. The United States largely follows the "American Rule," where each side pays their own costs. This is worlds apart from Germany's statutory fee schedule or Switzerland's "loser-pays" model.

These differences highlight a key point: payment rules are intensely local. You can't assume a one-size-fits-all approach works. To see how different these systems are, you can learn more about these different global attorney fee structures. This is why knowing that other attorneys accept payment plans isn’t enough. You have to understand the specific rules that apply to your firm.

Your ethical obligation is to ensure the client fully understands the terms before they agree to anything. A confusing payment plan can quickly become a compliance nightmare.

And given the sensitive financial data involved, think about security. Sending payment details via text might seem convenient, but it's crucial to understand the inherent SMS security risks to protect client data properly. The bottom line: this is not legal advice. Check with your state bar before you roll out any new payment policy. A few questions now can prevent major headaches later.

Using Technology to Automate Your Firm's Billing

Chasing payments and drowning in manual invoices is a massive time-waster. The technology to eliminate this entire process exists, but a surprising number of small firms are still doing it the hard way. The right tools don't just help you get paid faster; they make your firm look sharper and more professional from the very first interaction.

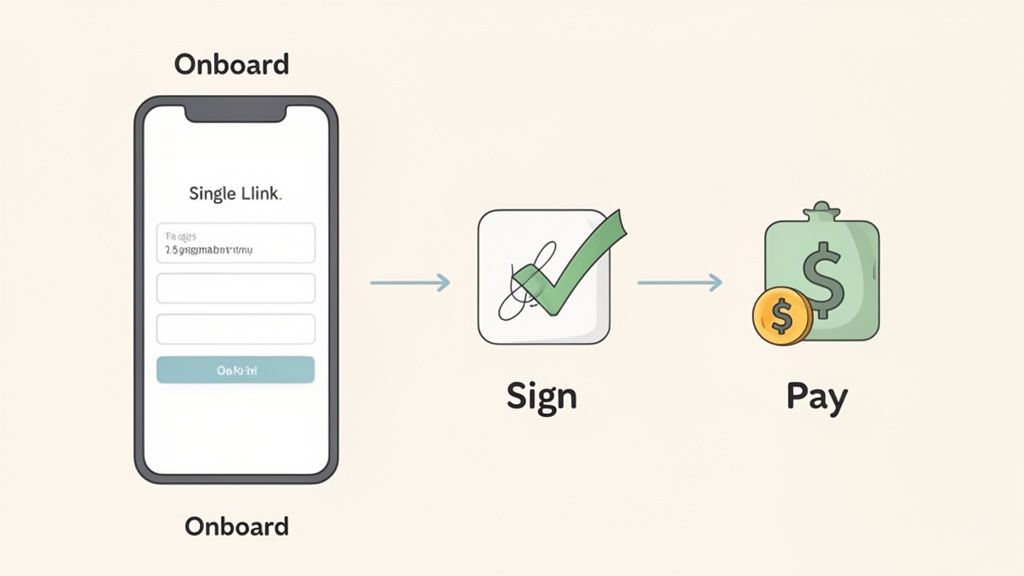

This is a game-changer when you start offering payment plans. The fix is to build payment collection right into your client onboarding process. You send a potential client one link where they can fill out their intake form, sign your retainer, and set up their monthly payments—all before your first official meeting.

Key Features for Automated Payment Solutions

To truly escape manual billing, you need more than a "Pay Here" button on your website. You need a system that handles the entire financial side of onboarding a new client. This approach gets rid of awkward follow-up calls and ensures you get paid on time without feeling like a bill collector.

Here are the non-negotiable features you should look for:

- Integrated Intake and Payments: The system must let a client provide payment details at the same time they fill out forms and sign the fee agreement. Merging these steps drastically reduces client drop-off.

- Automated Recurring Billing: This is essential for any installment plan. You need the ability to automatically charge a client's saved card or bank account each month.

- Secure Payment Processing: The platform must use a trusted, secure payment processor like Stripe to protect both you and your clients.

- Practice Management Integration: Your payment tool needs to talk to your other software. When a client pays, that information should appear in their file automatically. See our guide on the best legal CRM software to connect these dots.

The point is to create a client experience with zero friction. When it's easy for clients to hire and pay you, they are far more likely to do it immediately—before they have a chance to call another firm.

From Manual Work to Automated Workflow

Think about your current process. A client says yes. You email a retainer. They print, sign, scan, and email it back. Then you send a separate invoice. They have to find a checkbook or log into a clunky portal. Each step is a friction point where a hot lead can go cold.

An automated system crushes those steps into one smooth motion. You send one link. The client signs, pays, and completes intake on their phone in minutes. Your system automatically creates their file, logs the payment, and sends a confirmation. You just turned a multi-day administrative chore into a five-minute, hands-off conversion.

Your Top Questions About Law Firm Payment Plans

You have the framework, but questions always pop up when implementing a new system. Let's tackle the most common ones that small firm owners ask.

What is a fair down payment to require?

There’s no magic number, but a solid starting point is 25% to 50% of the total flat fee or initial retainer. Your down payment should, at a minimum, cover your initial hard costs and the first real chunk of your time.

When a client puts down a meaningful payment, they’re financially invested from day one. This one move dramatically cuts the risk of them ghosting you later. It’s essential protection for your cash flow.

Can I charge interest or late fees on unpaid balances?

In many places, yes. But you absolutely must check your state bar's specific rules. You can't just invent a late fee policy. Ethical guidelines are often very specific about the maximum interest you can charge and demand you spell these terms out clearly in your written fee agreement.

If you go this route, keep it simple and automated. A small, flat late fee or a modest interest charge can nudge clients to pay on time. Just make sure it's ethically sound and communicated upfront.

What happens if a client stops paying?

This is the fear that holds most attorneys back. Your fee agreement is your first and best defense. It needs to clearly state the consequences of non-payment, from pausing work on their case to formally withdrawing as counsel.

Having a clear, written policy isn't about being confrontational; it's about setting professional boundaries. It ensures that if a client defaults, you have a pre-defined, ethical process to follow that protects your firm.

Long before it gets to that point, a good automated billing system should send reminders for overdue payments. This often resolves the issue without you ever making an awkward phone call.

Do I need special software to offer payment plans?

Technically, no. But managing payment plans with spreadsheets and calendar alerts is a recipe for disaster. It's a massive administrative headache begging for human error. In fact, attorneys who switch to automated systems report saving over 10 hours per month on administrative tasks alone.

Modern intake and payment tools automate the whole process. They handle recurring billing, send reminders, and securely store payment info, turning a potential nightmare into a smooth, hands-off operation.

To make it even clearer, here’s a quick rundown of these key questions.

Your Top Questions Answered

| Question | Answer |

|---|---|

| What's a fair down payment? | Start with 25-50% of the total fee. It should cover your initial costs and time, ensuring the client is invested from the start. |

| Can I charge late fees? | Usually, yes, but you must follow your state bar's rules on rates and disclosures. Get it in writing in your fee agreement. |

| What if a client defaults? | Your fee agreement should outline the consequences, like pausing work or withdrawing. Automated reminders can often prevent this. |

| Do I need special software? | While not required, managing plans manually is inefficient and risky. Automation saves time and prevents costly errors. |

Hopefully, these answers give you the confidence to start implementing a payment plan system that works for both you and your clients.

At intake.link, we believe getting paid shouldn't be the hardest part of your job. Our platform combines intake forms, e-signatures, and automated payments into a single, seamless link.

Stop losing leads—get signatures before they call another firm