Tired of chasing down clients for payment? A lawyer retainer definition is simple: it's an upfront payment to secure your services, ensuring you get paid for your work from day one. It's the key to a stable cash flow and filtering out clients who aren't serious about moving forward.

What a Lawyer Retainer Actually Means for Your Firm

A retainer isn't just an advance payment; it's a tool that establishes a clear, professional relationship from the start.

When you collect a retainer, you're setting financial expectations immediately. Your client understands the initial investment, and you have the security to focus on their case without worrying if your next invoice will get paid. This initial payment fundamentally shifts the dynamic from hoping for payment to having funds secured before the real work begins.

The Role of the IOLTA Trust Account

Ethically, that retainer fee doesn't belong to your firm yet. You must deposit it into a dedicated Interest on Lawyers' Trust Account (IOLTA) or a similar client trust account. This is non-negotiable.

The money stays in this account, completely separate from your operating funds, until you have actually earned it by performing the work. This separation is critical—it protects the client's funds and keeps your firm compliant with state bar rules, preventing the illegal commingling of funds.

How to Define Your Retainer Amount

So, how much should you ask for? Calculating the right retainer means estimating the initial work involved. For example, a family law matter might command a $2,500 to $5,000 retainer, while complex commercial litigation could require $15,000 or more. You're setting a starting budget based on the anticipated scope. You can find more insights on fee structures over at Clio.com.

By defining the retainer clearly and using a trust account correctly, you build instant credibility. Mastering this is the first step to truly streamline your client intake process. It shows clients you're organized, professional, and trustworthy from the very first interaction.

What are the Different Types of Lawyer Retainers?

Not all retainers are the same. Picking the right model for a case sets the financial tone for the entire relationship. Get it right, and you create predictable cash flow. Get it wrong, and you’re setting yourself up for billing headaches and client friction.

Think of it like choosing a tool—you wouldn’t use a sledgehammer to fix a watch. A flat-fee retainer is perfect for a predictable uncontested divorce but is the wrong tool for messy, unpredictable litigation.

The Classic Security Retainer

This is the workhorse model for most law firms. A client pays an upfront amount, let's say $5,000, which you deposit directly into your IOLTA trust account.

As you perform work, you bill your time against that $5,000 balance. At the end of each billing cycle, you transfer the earned portion from the trust account to your firm's operating account. It’s a straightforward system that works well for cases where the total time commitment is uncertain.

This model is your go-to for matters like:

- Complex civil litigation

- Contentious divorce proceedings

- Ongoing business negotiations

The key benefit is flexibility. You’re paid for the actual work you do, protecting your firm from underbidding on a case that spirals into something more involved than anticipated.

The Evergreen Retainer

The biggest problem with a standard security retainer? The balance hitting zero right in the middle of a critical motion. Suddenly, you're financing the case out of your own pocket while you chase the client for more funds.

The evergreen retainer is the solution. It’s a self-refilling security retainer.

You simply add a clause to your retainer agreement setting a minimum balance—for example, $1,500. As soon as the client's trust funds dip below that threshold, they are automatically required to top it back up to the original amount. This simple mechanism keeps you from ever working on an empty tank and protects your cash flow.

The Flat-Fee Retainer

For services with a clearly defined scope, the flat-fee retainer is a powerful marketing tool. You charge one fixed price for the entire project, paid upfront, giving clients the cost certainty they crave. This is ideal for routine, predictable work like simple estate planning, uncontested divorces, or trademark registrations.

Yes, you lose the potential upside of hourly billing if a case takes longer than expected. But you gain a massive advantage by offering predictable pricing in a sea of hourly competitors. Just be absolutely sure you’ve scoped the work accurately.

Which Retainer Type Fits Your Case?

Choosing the right model comes down to the predictability of the work. This table breaks down the common models to help you match the retainer to the reality of the case.

| Retainer Type | How It Works | Best For Practice Areas | Key Benefit |

|---|---|---|---|

| Security Retainer | Client pays upfront funds held in trust. Firm bills hourly against the balance. | Litigation, Family Law, Business Negotiations | Flexibility for unpredictable work. |

| Evergreen Retainer | A security retainer that must be replenished when the balance falls below a set minimum. | Long-term Litigation, Complex Corporate Work | Ensures funds are always available, preventing cash flow gaps. |

| Flat-Fee Retainer | One fixed price for a clearly defined scope of services, often paid upfront. | Estate Planning, Uncontested Divorce, Criminal Defense | Predictable pricing for clients and streamlined billing for the firm. |

How Retainer Fees Work From Deposit to Final Invoice

Getting the retainer lifecycle right is critical for protecting your firm and building client trust. When you handle it correctly, the process is straightforward and heads off billing disputes before they start.

The Initial Deposit into IOLTA

First, the client’s retainer payment must not go into your firm's operating account. That money is still theirs until you perform the work. You have to deposit the full amount directly into your Interest on Lawyers' Trust Account (IOLTA) to keep the funds separate.

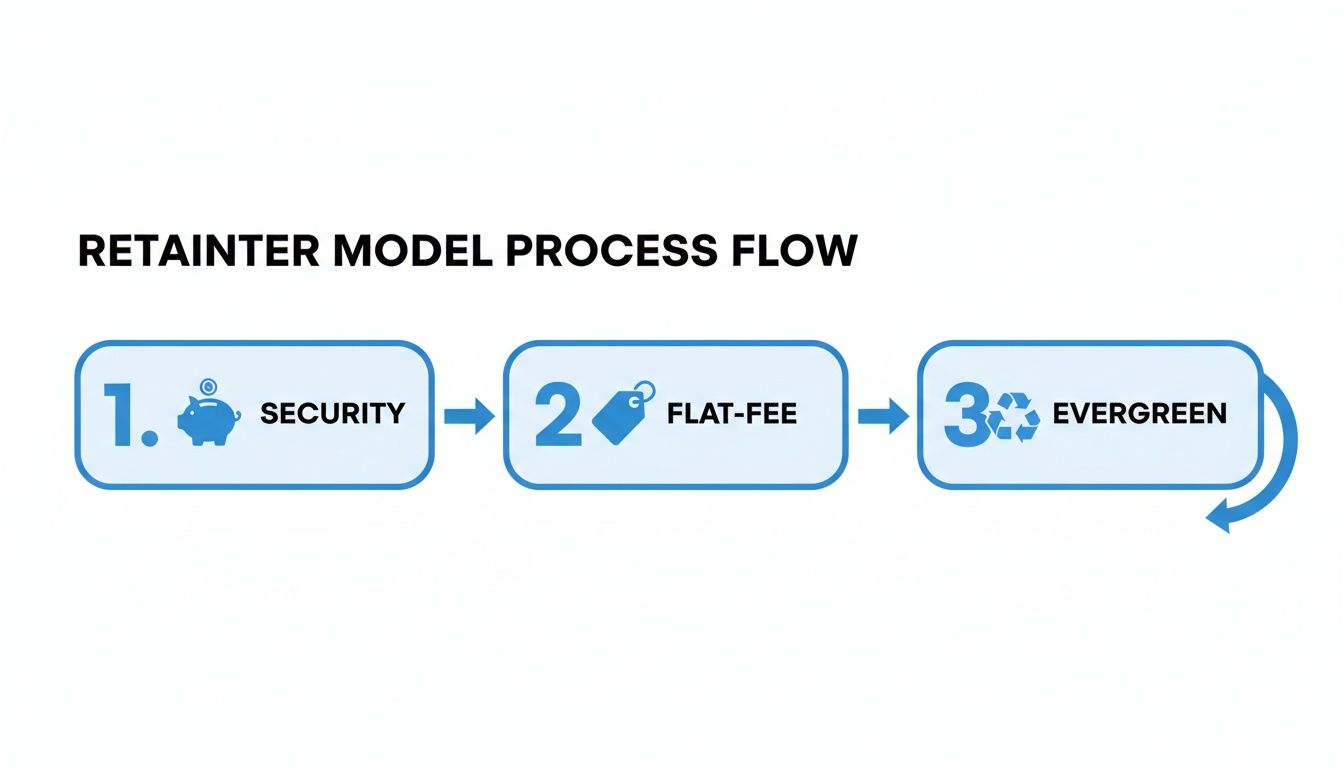

This visual shows the basic flow for the most common retainer models.

While each model—Security, Flat-Fee, and Evergreen—serves a different strategic purpose, they all share that same ethical foundation: keep client funds separate.

Billing Against the Retainer Balance

Once the funds are in your trust account, you can get to work. At the end of each billing period (usually monthly), you’ll generate a detailed invoice for the client. This invoice must clearly itemize every task, the time spent, and the corresponding charges. Transparency is your greatest asset here.

Only after you've sent the invoice to the client can you transfer the exact earned amount from your IOLTA to your firm’s operating account. For example, if your rate is $250/hour and you take a $2,500 retainer, after billing for two hours of work ($500), you send an invoice and then move $500 from IOLTA to operations. The trust account now holds $2,000.

Handling Refunds and Closing the Loop

What happens if the case ends and there’s still money in the trust account? You must return it to the client, promptly. Any unearned portion of a security retainer is 100% refundable.

The Bottom Line: The retainer lifecycle—Deposit, Work, Invoice, Transfer, and Refund—is a cycle of trust. Following these steps meticulously keeps you compliant and shows clients you handle their money with integrity.

To get a better handle on setting the right amount upfront, check out our guide on calculating the ideal lawyer retainer fee.

Drafting an Ironclad Retainer Agreement

Your retainer agreement is your firm’s best defense against scope creep and billing disputes. A vague agreement is a future headache, but a clear one sets a professional tone from day one, letting you practice law instead of arguing over invoices.

Must-Have Clauses for Your Agreement

Think of your agreement as a roadmap for the attorney-client relationship. To avoid getting lost, it needs specific, unambiguous clauses.

- Scope of Services: Be surgically precise. Don’t just say "handle the divorce." Specify "representation through mediation, filing of the initial petition, and negotiation of a marital settlement agreement, excluding trial representation." This prevents clients from assuming your work extends to appeals.

- Detailed Fee Structure: Clearly state your hourly rate, the exact initial retainer amount, and how you’ll bill against it. If it's a flat fee, define precisely what it covers and what work would be considered extra.

- Evergreen Replenishment Clause: This is critical for your cash flow. Include a clause that requires the client to replenish the retainer once the balance drops below a specific threshold (e.g., $1,500). This ensures you’re never financing a client's case.

An airtight retainer agreement is the most effective tool for managing client expectations. It transforms potential conflicts into mutual understanding, paving the way for a smoother relationship.

Communication, Costs, and Termination Policies

A great agreement also governs the day-to-day working relationship. Don't leave these points to chance.

Your agreement should spell out:

- Billable vs. Non-Billable Costs: Specify which expenses the client is responsible for, like filing fees and expert witness costs.

- Communication Protocols: Set boundaries. State your firm’s standard response time (e.g., within one business day).

- Termination Clause: Detail the process for ending the engagement, how final fees will be calculated, and how any remaining trust funds will be promptly refunded.

To help you get started, you can download a legal retainer agreement template to see how these clauses look in practice.

How to Collect Retainers in Minutes, Not Days

The biggest roadblock for most small law firms isn't the legal work; it's the delay between a client saying "yes" and you receiving a signed retainer and payment. Every hour spent waiting for them to print, sign, scan, and email a document is an hour they can call your competitor.

Unify Your Intake Into a Single Step

Imagine this: you finish a great consultation and, before the potential client hangs up, you send them a single, secure link. On their phone, they can review and e-sign your retainer agreement, pay the deposit with a credit card, and fill out your initial intake form in one seamless flow.

This isn't a fantasy; it's how modern firms operate. It removes the friction that makes leads go cold. This speed is your competitive advantage. Research shows 67% of clients choose the first firm that responds professionally, and nothing is more professional than making it easy to hire you.

How a One-Link Workflow Actually Works

A unified intake system turns three clunky tasks into one fluid experience.

Here’s the breakdown:

- Step 1: Send the Link. Right after the consultation, send your custom link via email or text.

- Step 2: Sign and Pay. The client opens it, e-signs the agreement, and pays the retainer instantly via credit card or ACH.

- Step 3: Complete Intake. They then flow directly into your firm's intake questionnaire, providing all the case details you need.

The entire process can be done in under five minutes. The signed agreement, payment confirmation, and client data are all instantly organized in your system.

By crushing these delays, you don't just lock in more clients—you get to work on their cases faster. Learn more about designing an effective legal client intake form that captures the right information from the start.

Capitalizing on the Corporate Shift to Retainers

The market is sending a clear signal: businesses are fed up with unpredictable hourly bills. They want budget certainty, creating a massive opportunity for your small firm to lock in stable, recurring revenue.

When you offer retainer-based services, you stop being a reactive problem-solver and become an indispensable strategic partner embedded in their operations.

Meeting the Demand for Predictable Spending

Your business clients crave predictability. They would much rather budget for a consistent monthly fee than get hit with a surprise five-figure invoice. The data backs this up: the use of retainers by in-house legal departments surged by 21% in a single year, according to the Association of Corporate Counsel. The demand is there—all you have to do is meet it.

How to Structure Your Retainer Packages

Your firm can jump on this trend by creating retainer packages that cover ongoing legal needs businesses face every month.

Think about offering monthly retainers that cover services like:

- Contract Review: A set number of contract reviews per month (e.g., up to 5).

- General Counsel Services: A block of hours for general advice, compliance, and strategy calls.

- HR and Employment Issues: On-call support for navigating tricky hiring and termination questions.

By proactively offering these packages, you’re not just selling your time—you’re selling peace of mind. It’s a powerful value proposition that transforms one-off projects into long-term, profitable client relationships.

Common Questions About Lawyer Retainers

Let’s tackle the questions that come up most often about retainers so you can lead client conversations with confidence.

What Is the Difference Between a Retainer and a Flat Fee?

A retainer is a down payment on future hourly work, held in a trust account. You bill your time against this deposit. A flat fee is a single, all-in price for a well-defined project, like drafting a will. It’s for a specific outcome, not a block of your time.

Are Lawyer Retainers Always Refundable?

Yes, for nearly all cases. A standard security retainer is always refundable for any portion you haven't earned. State bar rules are strict: if you haven't done the work, you can't keep the money. It's that simple.

A rare exception is a "general retainer" paid just to keep you on standby, but these are complex and risky for most small firms. For the 99% of cases you'll handle, assume any unearned funds must be returned.

How Do I Handle a Client Disputing a Retainer Charge?

Prevent disputes with incredibly detailed invoices. Itemize every task so the client sees exactly where their money went. If a dispute still happens, address it immediately. Walk the client through your time records and explain the value of the work performed. Meticulous records and calm communication resolve most issues.

What Happens if the Retainer Runs Out Mid-Case?

This is why your retainer agreement must have an Evergreen Retainer clause. This requires the client to replenish their retainer balance whenever it dips below a set threshold (say, $1,500). This simple provision ensures you're never funding a client's case out of your own pocket.

See how intake.link consolidates your entire intake process. You can send one link to get your agreement signed, collect the retainer payment, and capture all client details in minutes. Learn how intake.link closes clients faster.